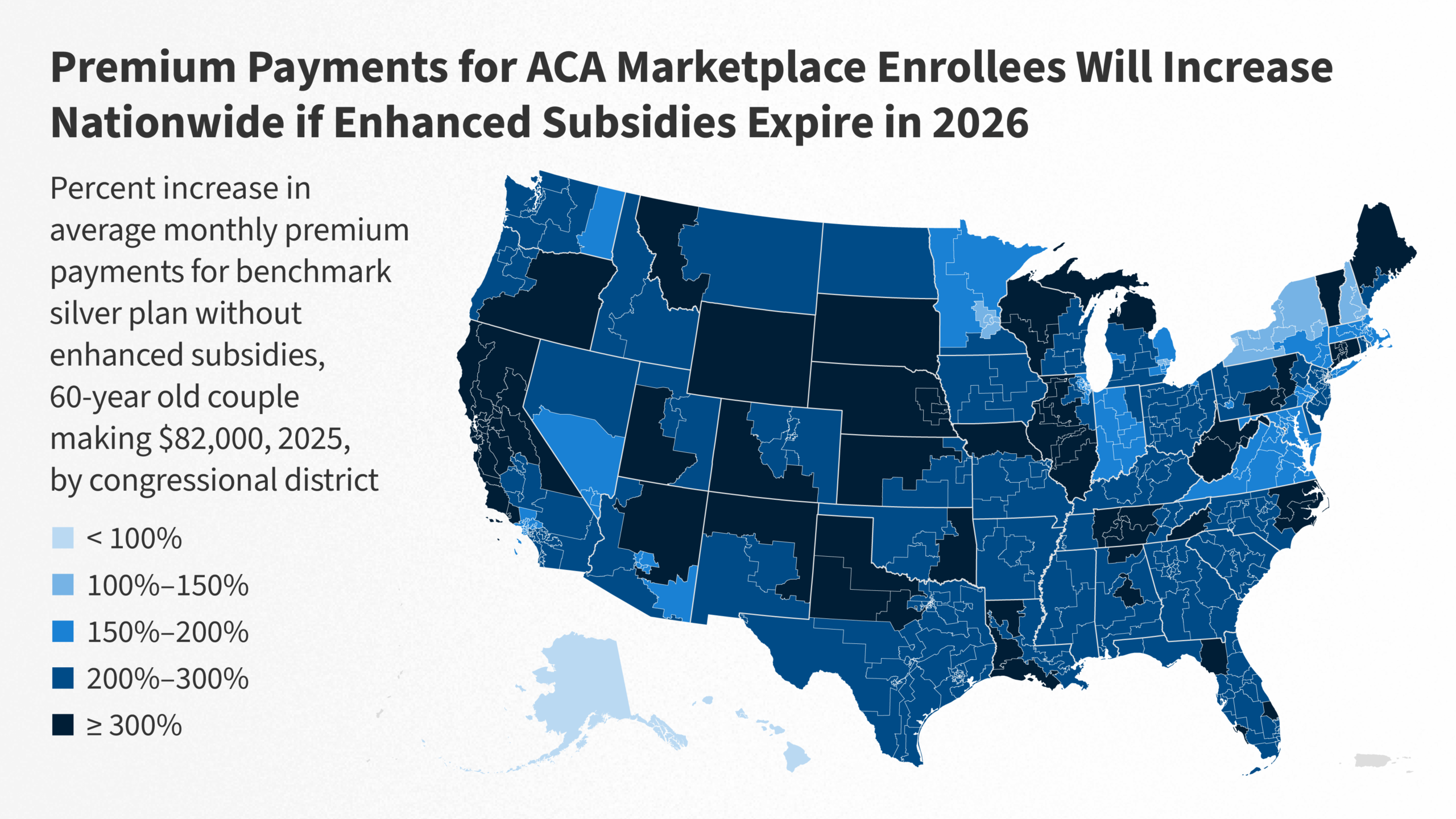

The dominant story in U.S. insurance right now is the expiration of enhanced Affordable Care Act (ACA) premium tax credits on December 31, 2025, leading to significant health insurance premium increases starting January 1, 2026. Other Notable Developments Health insurance affordability under the ACA remains the top headline, with potential…

Louisiana Car Insurance Rates 2026: New Laws Bring Relief with Rate Decreases

Louisiana car insurance rates 2026 are poised for notable declines following the implementation of new laws effective January 1, aimed at addressing the state’s previously highest-in-the-nation premiums. These reforms, signed by Governor Jeff Landry, focus on tort and insurance changes to reduce costs for drivers, with major insurers like State…

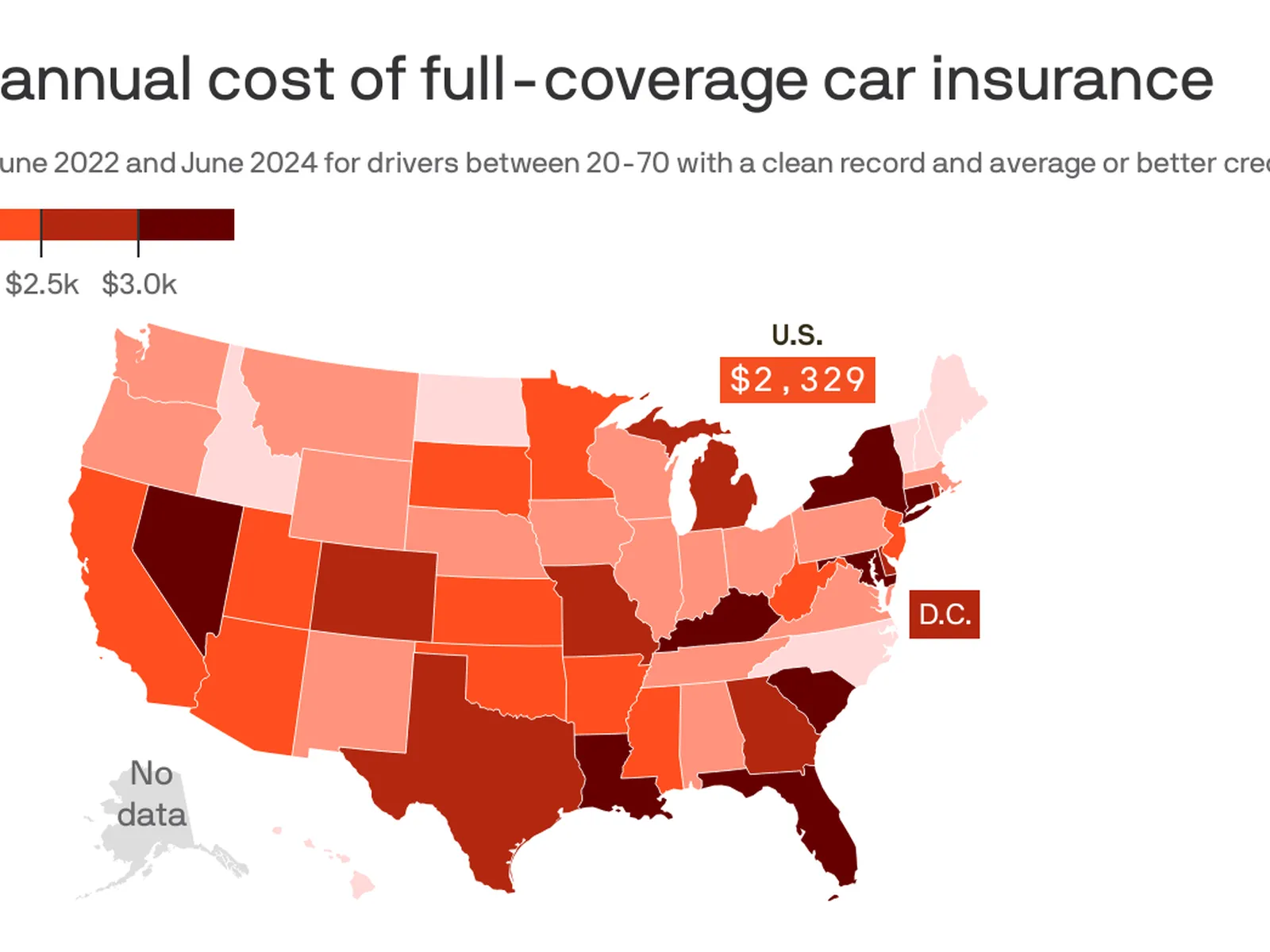

US Car Insurance Rates 2026: Latest Trends, Averages, and State Comparisons

US car insurance rates 2026 are a hot topic as drivers across the nation grapple with ongoing adjustments in premiums. According to recent data from Bankrate and other sources, the national average for full coverage car insurance has climbed to approximately $2,697 per year, or about $225 per month, reflecting…

US Car Insurance Profitability 2025: A Comprehensive Analysis

In the landscape of US car insurance profitability 2025, the market is demonstrating signs of steadying after years of turbulence. Recent data highlights a significant improvement in personal auto combined ratios, dropping from over 112% in 2022 to around 95% in 2025, reflecting a shift toward underwriting profitability. This recovery…

Workers Compensation for Seasonal Farm Laborers in the USA: 2025 Complete Guide

Workers compensation for seasonal farm laborers is one of the most misunderstood and under-utilized coverages in American agriculture. Every year, thousands of U.S. farms hire H-2A workers, local high school students, harvest crews, and migrant laborers to pick fruit, detassel corn, bale hay, or run packing lines — yet many…

Best Agricultural Insurance for Organic Farms in the USA: 2025 Expert Guide

Finding the best agricultural insurance for organic farms in the United States is dramatically different from insuring a conventional row-crop operation. Organic farmers face unique risks — higher input costs, stricter certification rules, transitional acreage vulnerabilities, contamination threats, and premium price volatility — that most standard farm policies either exclude…

Does Crop Insurance Cover Flood Risks in Midwest? The Complete 2025 USA Guide

Does crop insurance cover flood risks in Midwest states like Iowa, Illinois, Nebraska, Missouri, and Minnesota? This is the #1 question Midwest farmers ask every spring as snow melts and rivers swell. The short answer is: It depends entirely on which type of crop insurance you bought. While standard Multi-Peril…

Cheap Equipment Insurance for Harvest Season: Protect Your U.S. Farm Machinery Without Breaking the Bank

Cheap equipment insurance for harvest season is one of the smartest investments American farmers can make as fall approaches. Harvest is the most intense, high-stakes period of the year — combines, grain carts, tractors, and augers run around the clock, often in muddy fields, at night, and under extreme pressure…

Farm Liability Insurance for Agritourism Businesses: Essential Protection for U.S. Farmers

Farm liability insurance for agritourism businesses is a critical safeguard for farmers across the USA who open their properties to the public for recreational and educational activities. As agritourism continues to grow in popularity, offering experiences like pumpkin patches, hayrides, farm tours, and pick-your-own produce, the need for comprehensive coverage…

Personal Insurance Quotes for Holiday Home Risks: Complete 2025 Guide for U.S. Vacation Property Owners

If you own or plan to own a vacation property, getting accurate and personal insurance quotes for holiday home risks is one of the most crucial financial steps you can take. Holiday homes—whether located near beaches, mountains, lakes, or tourist-friendly locations—face significantly higher risks compared to primary residences. From break-ins…