In the landscape of US car insurance profitability 2025, the market is demonstrating signs of steadying after years of turbulence. Recent data highlights a significant improvement in personal auto combined ratios, dropping from over 112% in 2022 to around 95% in 2025, reflecting a shift toward underwriting profitability. This recovery is underpinned by moderated premium growth and easing affordability pressures, as evidenced by the Consumer Price Index (CPI) for motor vehicle insurance slowing to just 3.1%. As we delve deeper into this topic on December 25, 2025, this article explores the key drivers, trends, and implications for insurers, consumers, and the broader economy, drawing on authoritative sources to ensure accuracy and reliability.

Introduction to US Car Insurance Profitability 2025

The US auto insurance industry has undergone a remarkable transformation in recent years, culminating in a positive outlook for US car insurance profitability 2025. After grappling with substantial losses in 2022, where combined ratios exceeded 112% indicating that insurers were paying out more in claims and expenses than they collected in premiums the sector has rebounded strongly. By 2025, these ratios have improved to approximately 95%, signaling a return to profitability for many carriers.

This improvement is not merely a statistical anomaly but a result of strategic adjustments, including rate hikes implemented in prior years, better claims management, and a moderation in catastrophic losses

According to the 2025 U.S. Auto Insurance Study by J.D. Power, the nation’s auto insurers have returned to profitability for the first time in years, allowing them to pivot from defensive strategies like raising rates and exiting unprofitable markets to proactive ones focused on acquiring and retaining high-value customers.

This shift is crucial in a market where customer satisfaction plays a pivotal role in renewal rates and overall stability. The study, based on responses from over 48,000 customers surveyed between May 2024 and April 2025, underscores that while profitability is on the rise, challenges in customer experience could impact long-term gains.

Furthermore, broader property and casualty (P&C) industry reports corroborate this trend. Fitch Ratings anticipates that the full-year combined ratio for the US P&C sector will remain below 100% in 2025, building on the 97% achieved in 2024.

For personal auto specifically, Moody’s reports a weighted average combined ratio of 85.5% in the first half of 2025, a notable improvement from 88.6% in the prior year, driven by reduced claim severity and frequency.

These figures highlight how the industry has addressed profitability issues through disciplined underwriting and premium adjustments.

Historical Context: From Losses in 2022 to Recovery in 2024

To fully appreciate US car insurance profitability 2025, it’s essential to examine the historical backdrop. In 2022, the personal auto segment faced severe headwinds, including elevated claims costs due to inflation, supply chain disruptions for vehicle repairs, and increased accident frequency post-pandemic. The combined ratio soared above 112%, resulting in a net operating loss exceeding $21 billion for auto physical damage and liability combined.

Insurers responded with aggressive rate increases, averaging 26% across the board, with some states seeing hikes over 40%.

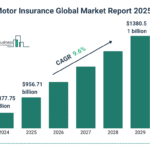

By 2024, these measures bore fruit. The industry recorded a record net profit of $169 billion for the entire P&C sector, a 90% increase from 2023 and a staggering 333% jump from 2022.

Specifically for personal auto, net underwriting income turned positive at nearly $14 billion, reversing three consecutive years of losses.

Direct written premiums grew 13.6% to $359 billion, supported by rate hikes that eased to 10% year-over-year from 15% in 2023.

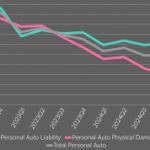

The combined ratio for auto physical damage improved to 87.9% from 101.2% in 2023, illustrating a path to sustainability.

This recovery was bolstered by lower catastrophe losses and stabilized loss ratios. For instance, the direct loss ratio for personal auto dropped to 67.6% in the first half of 2024 from 77.1% in the same period of 2023.

Investment income also played a role, rising to $85 billion in 2024 from $70 billion the previous year, providing a buffer against underwriting volatility.

Key Trends in US Car Insurance Profitability 2025

Entering 2025, the momentum from 2024 has carried forward, with US car insurance profitability 2025 characterized by continued underwriting improvements. The first-half 2025 direct loss ratio for personal auto stands at 61.2%, a significant decline from previous years, indicating better control over claims payouts.

Earned premiums have grown 3.9% to $453 billion in the first half, driven by sustained rate adjustments and increased written premiums.

Premium growth has cooled, aligning with easing affordability issues. The CPI for motor vehicle insurance dropped to 3.1% in 2025, a sharp slowdown from the 22.6% increase seen in prior periods.

This moderation is welcome news for consumers, who have faced cumulative rate increases of 35% from January 2022 to the end of 2024.

Insurers are now in a position to pursue growth, with some even filing for rate decreases for the first time in years.

However, not all indicators are uniformly positive. Third-quarter results from major players like Progressive and GEICO reveal slight deteriorations in combined ratios compared to 2024, primarily due to elevated expenses rather than losses.Progressive’s Q3 personal auto combined ratio was 90.7%, influenced by a 5.5-point accrual for consumer refunds in Florida and increased advertising costs totaling $1.3 billion for the first nine months.

Similarly, GEICO’s expense ratio rose to 12.8%, with projections for advertising spend reaching $1.9 billion in 2025, potentially pushing ratios higher.Despite these pressures, both companies remain profitable, with loss and adjustment expense ratios below 75% for multiple quarters.

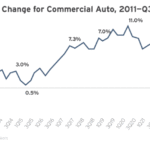

In the broader P&C context, Q2 2025 saw insurers approaching peak profitability, with a statutory combined ratio of 94.1% for the quarter.Personal auto drove much of this, benefiting from lower loss ratios in commercial auto liability (down 6.3 percentage points from Q1 2025).Swiss Re’s outlook describes “sunny skies” for the US P&C industry in 2025, though it advises caution due to potential cat losses.

Factors Driving Profitability

Several factors contribute to the enhanced US car insurance profitability 2025. First, rate adequacy has been achieved through prior increases, allowing premiums to better match rising claims costs. The average cost per private passenger auto claim reached nearly $13,000 in 2024, up over 10% year-over-year, but a reduction in claim frequency since the pandemic has tempered total loss costs.

Second, driving behaviors have influenced loss trends. While violations increased 17% year-over-year in 2024, with distracted driving up 50%, insurers have adapted through telematics and usage-based insurance to mitigate risks.

DUI incidents rose 8%, particularly among older drivers, but overall, incurred loss ratios stabilized throughout 2024 and into 2025.Overall satisfaction dipped to 644 out of 1,000 in 2025, with 38% of customers expressing dissatisfaction, potentially leading to higher shopping rates.High-value customers, who pay higher premiums and hold multiple policies, show the lowest renewal intent at 51%, prompting insurers to invest in digital channels and personalized services.

Challenges and Risks Ahead

Despite the optimistic US car insurance profitability 2025, challenges persist. Claims costs continue to escalate due to advanced vehicle technologies and repair complexities. Social inflationrising litigation and settlement amounts remains a concern in casualty lines.

Additionally, potential economic factors like higher tariffs could impact claim severity and profit margins.

Natural disasters pose another risk. While 2025 has seen lower catastrophe losses so far, events like California wildfires contributed to a 99% combined ratio in Q1 for P&C overall.

Fitch warns that wildfire losses and other cats could push the full-year ratio modestly higher, though still under 100%.

Competition is intensifying, with slower premium growth (around 5% for GEICO) and increased advertising spends eroding expense ratios.

Projections from Captive.com suggest personal auto will maintain profitability but with a potential combined ratio of 107.1 in certain segments by year-end, highlighting variability.

Future Outlook and Implications

Looking ahead, US car insurance profitability 2025 is poised for sustained improvement, with experts like AM Best affirming a positive outlook into the year.

The NAIC’s mid-year report notes sharp improvements led by personal lines, with the overall P&C combined ratio at 96.4% in 2024 and trending favorably.

For consumers, this could mean more stable rates, though affordability remains a priority amid ongoing economic pressures

Insurers must balance profitability with customer-centric strategies to avoid churn. As Stephen Crewdson from J.D. Power emphasized, “Now that insurers are shifting back into growth mode, they really need to focus on cultivating and keeping high-value customers.”

Policymakers may also scrutinize the industry, given the record profits achieved alongside rate hikes, to ensure fair practices. In conclusion, US car insurance profitability 2025 represents a milestone in the industry’s resilience. From the depths of 2022 losses to the heights of 2025 gains, the sector has demonstrated adaptability. With combined ratios stabilizing around 95%, cooled premium growth, and easing CPI pressures, the future looks promising provided insurers navigate emerging risks effectively. This authoritative analysis, grounded in the latest data as of December 25, 2025, underscores the importance of vigilance in maintaining this upward trajectory.

📚 You May Also Like

💡 Lawyers for Car Insurance Claims in Texas: Complete Legal Guide 2025

Learn which Texas-based attorneys provide the strongest legal representation and highest claim success rates this year.

🚗 Finding an Auto Insurance Attorney in Dallas

Explore top-rated Dallas attorneys helping victims maximize compensation for vehicle damage and medical expenses.

⚖️ Auto Insurance Attorney in Philadelphia – 2025 Legal Help, Best Lawyers, and Claim Guide

🔥 Auto Insurance Attorney in the USA – 2025 Legal Help, Top Lawyers, and Filing Guide

See how USA ranks and what factors drive up insurance rates across the country.