Louisiana car insurance rates 2026 are poised for notable declines following the implementation of new laws effective January 1, aimed at addressing the state’s previously highest-in-the-nation premiums. These reforms, signed by Governor Jeff Landry, focus on tort and insurance changes to reduce costs for drivers, with major insurers like State Farm already announcing a 5.9% average rate decrease for over 1 million policyholders.

Overview of the New Laws

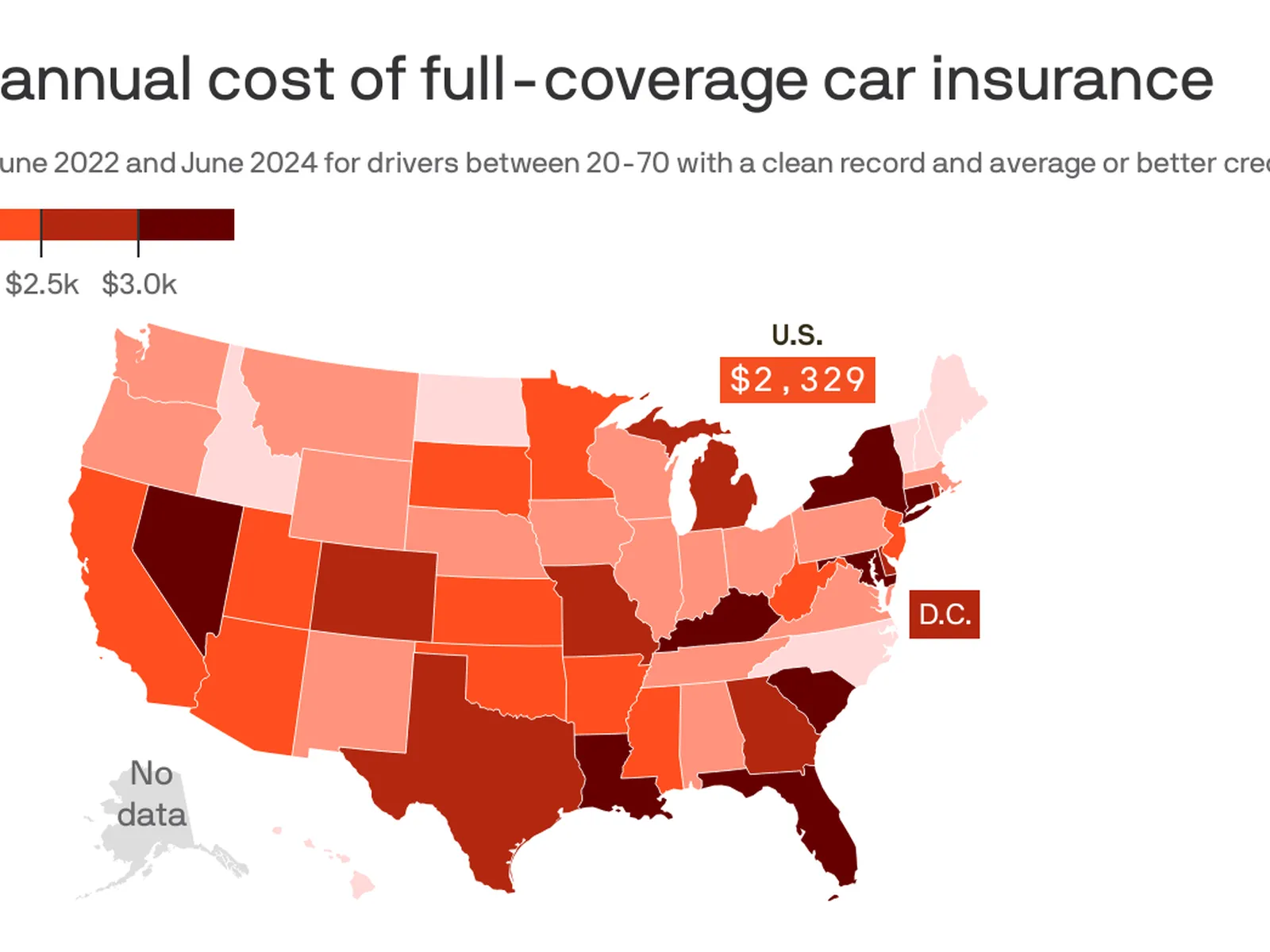

The package of legislation, enacted during the 2025 session, targets key drivers of high auto insurance costs in Louisiana, which averaged $3,481 to $3,718 annually for full coverage in 2025—up to 75% above the national average of around $2,124.Key provisions include:

- Tort Reform: Laws like those limiting lawsuit awards and adjusting medical cost considerations in claims, allowing partial recovery of damages if a driver is 50% or less at fault, reduced by their responsibility share. knoe.com

- Insurer Regulations: Act 85 prohibits passing advertising costs to customers; Act 476 prevents rate hikes due to coverage lapses; Act 429 requires insurers to notify the Department of Insurance of regional policy changes. lobservateur.com

- Other Measures: Broader reforms aim to hold both insurers and litigants accountable, curbing excessive profits and injury claims, which are twice the national average per accident in Louisiana.

These changes build on over 20 rate decrease filings by insurers in 2025, signaling a shift toward affordability.Governor Landry described the reforms as a “balanced approach” to lower rates, previously the highest in the U.S.

Impact on Rates and Insurers

State Farm, holding 30% of Louisiana’s personal auto market, received approval from Insurance Commissioner Tim Temple for a 5.9% average auto rate cut effective January 1, 2026, impacting 1,066,000 policyholders.Individual savings vary by risk factors, but for a typical $3,600 annual premium, this could mean about $212 in reductions.Other insurers like GEICO, Allstate, and Progressive have also filed decreases recently.

Commissioner Temple noted the drop stems from fewer accidents and claims, but sustained relief requires ongoing legal reforms.While auto rates fall, homeowners insurance sees increases (e.g., State Farm’s 9.7% hike), driven by hurricane risks.

Rate Comparison Chart

Tips for Louisiana Drivers

With these reforms, experts recommend shopping around for quotes, as competition intensifies. Maintain good driving records and consider bundling policies for additional savings. While Louisiana’s rates remain high compared to states like Vermont ($1,239 average), the 2026 changes mark a positive step toward alignment with national trends.

📚 You May Also Like

💡 Finding the Right Auto Insurance Attorney in Texas

🚗How Much Does Personal Umbrella Insurance Cost in 2025? A Complete USA Guide

Explore top-rated USA attorneys helping victims maximize compensation for vehicle damage and medical expenses.

⚖️ US Car Insurance Rates 2026: Latest Trends, Averages, and State Comparisons

Discover the pros and cons of managing your car insurance claim independently versus hiring a legal expert.

🔥US Car Insurance Profitability 2025: A Comprehensive Analysis

See how US ranks and what factors drive up insurance rates across the country.