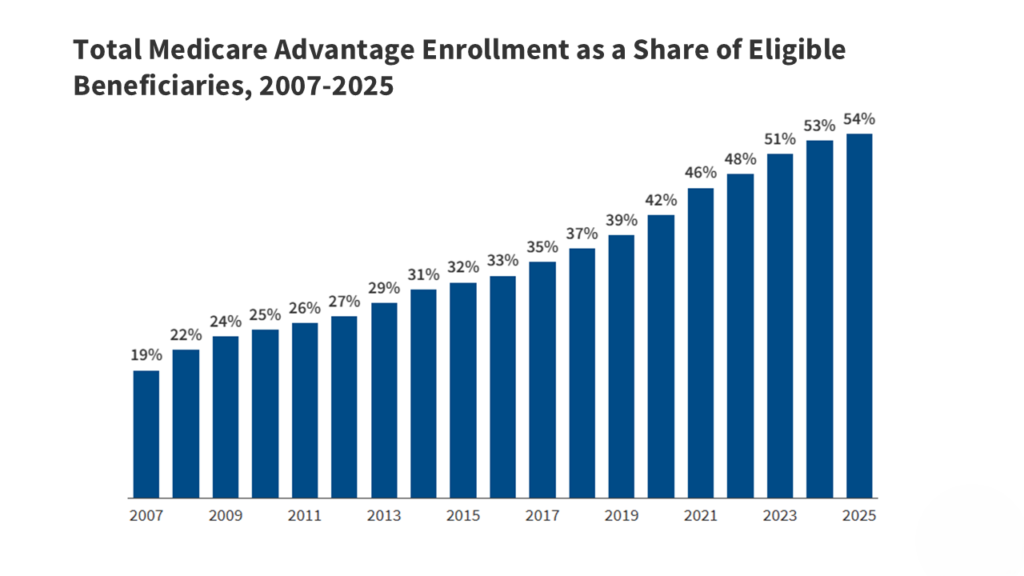

As America’s population ages, Medicare Advantage (Part C) plans have become a cornerstone of senior healthcare. With more than 31 million Americans enrolled in Medicare Advantage plans in 2024, experts predict continued growth in 2025 — especially as providers add telehealth benefits, fitness programs, and dental or vision coverage.

In this comprehensive guide, we’ll break down the best Medicare Advantage plans for seniors in 2025, how to compare them, and which lawyers and advisors can help you navigate coverage disputes or enrollment issues.

Whether you’re new to Medicare or looking to switch plans this year, this post will help you make an informed, confident decision.

What Is a Medicare Advantage Plan?

Medicare Advantage, also called Medicare Part C, is an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare and typically include:

- Hospital coverage (Part A)

- Medical coverage (Part B)

- Prescription drug coverage (Part D)

- Extra benefits like dental, hearing, and vision care

For many seniors, Medicare Advantage provides better coordination, predictable out-of-pocket costs, and extra perks that Original Medicare doesn’t cover.

Why 2025 Is a Crucial Year for Seniors Choosing Medicare Advantage

The Centers for Medicare & Medicaid Services (CMS) announced that 2025 plan premiums will remain stable, but benefits and provider networks are expanding.

Key updates for 2025 include:

- Increased mental health coverage through teletherapy.

- Broader dental and hearing benefits for major carriers.

- Stronger fraud protection rules for Medicare marketing.

- Star Ratings adjustments — giving more weight to customer satisfaction and care coordination.

If you’re turning 65 in 2025 or considering a switch, now is the perfect time to review your options.

Top 5 Medicare Advantage Plans for Seniors (2025)

Below are the most trusted and best-rated Medicare Advantage providers in the U.S. for 2025, based on data from CMS, JD Power, and verified consumer feedback.

| Provider | Notable Plan | Average Monthly Premium | Star Rating (CMS) | Best For |

|---|---|---|---|---|

| UnitedHealthcare (AARP) | AARP Medicare Advantage Choice | $0–$45 | ★★★★★ | Broad network & fitness benefits |

| Humana | Humana Gold Plus HMO | $0–$40 | ★★★★☆ | Great prescription coverage |

| Blue Cross Blue Shield (BCBS) | Blue Advantage PPO | $25–$60 | ★★★★☆ | Nationwide flexibility |

| Kaiser Permanente | Senior Advantage | $0–$45 | ★★★★★ | Integrated care model |

| Aetna Medicare | Aetna Medicare Premier PPO | $0–$35 | ★★★★☆ | Affordable drug benefits |

1. UnitedHealthcare (AARP Medicare Advantage)

UnitedHealthcare, endorsed by AARP, is the largest Medicare Advantage provider in the nation. It offers robust preventive care, free fitness memberships through Renew Active, and strong customer satisfaction scores.

- Perks: $0 premium options, 24/7 nurse line, dental/vision coverage

- Ideal For: Seniors seeking flexible provider access and nationwide coverage

2. Humana Medicare Advantage

Humana’s Medicare Advantage plans shine with excellent prescription coverage and no annual deductibles on several plans. Their Humana Gold Plus HMO plan has consistently earned high ratings for member satisfaction.

- Perks: OTC benefits, SilverSneakers, mail-order pharmacy discounts

- Ideal For: Seniors managing chronic conditions or on multiple medications

3. Blue Cross Blue Shield (BCBS)

Blue Cross Blue Shield operates through state affiliates (e.g., Anthem, Highmark, Horizon). Their PPO options give seniors freedom to visit any doctor or specialist without referrals — a major advantage for frequent travelers.

- Perks: National provider access, predictable copays, travel coverage

- Ideal For: Seniors who travel frequently or live in multiple states

4. Kaiser Permanente

🌐 healthy.kaiserpermanente.org

Kaiser Permanente’s integrated system — combining hospitals, physicians, and pharmacies — ensures seamless care. The Senior Advantage plan consistently earns top CMS ratings for preventive health and chronic disease management.

- Perks: Exceptional preventive care, $0 telehealth visits

- Ideal For: Seniors seeking coordinated, high-quality healthcare

5. Aetna Medicare Advantage

Aetna’s Medicare Advantage plans are known for affordability and strong prescription benefits. Many include $0 copays for primary care visits and low-cost generics.

- Perks: Free annual hearing and vision exams, low premiums

- Ideal For: Cost-conscious seniors

Legal & Advisory Experts for Medicare Advantage in the U.S.

Choosing or switching a Medicare Advantage plan can involve complex rules — from coverage denials to misleading advertisements. These top-rated lawyers and advisory services specialize in Medicare law, appeals, and compliance.

- Medicare Rights Center (National)

🌐 www.medicarerights.org

Nonprofit advocacy group providing expert help with Medicare Advantage disputes and appeals.

- Center for Medicare Advocacy (Washington, D.C.)

🌐 www.medicareadvocacy.org

Offers free legal resources and handles national Medicare litigation cases.

- Cona Elder Law (New York)

🌐 www.conaelderlaw.com

Specializes in elder law, Medicare appeals, and benefit disputes.

- Health Law Advocates (Boston, MA)

🌐 www.healthlawadvocates.org

Nonprofit legal aid for seniors denied Medicare or healthcare services.

These professionals can help seniors appeal plan denials, resolve billing errors, and understand policy fine print before committing to a long-term plan.

Average Cost of Medicare Advantage Plans (2025)

The average monthly Medicare Advantage premium in the U.S. for 2025 is projected to remain around $18–$25, according to CMS.

However, prices vary by state and plan type:

| State | Average Premium (2025) | Common Plan Type |

|---|---|---|

| Florida | $14 | HMO |

| California | $17 | PPO |

| Texas | $12 | HMO |

| New York | $23 | PPO |

| Illinois | $19 | HMO-POS |

Pro Tip: Many $0 premium plans still require copays, so always compare the maximum out-of-pocket limit (MOOP) — this figure caps your yearly expenses.

Enrollment Periods for Medicare Advantage

Understanding the right time to enroll or switch plans ensures you get the best coverage without penalties.

| Enrollment Type | Timeframe | What You Can Do |

|---|---|---|

| Initial Enrollment | 3 months before and after your 65th birthday | Enroll in Medicare Advantage for the first time |

| Open Enrollment | Oct 15 – Dec 7 annually | Switch or drop plans |

| Medicare Advantage Open Enrollment | Jan 1 – Mar 31 | Change to another MA plan or revert to Original Medicare |

Expert Insights

“Many seniors mistakenly believe higher premiums equal better coverage — but the best value often lies in PPO plans with $0 premiums and lower MOOPs.”

— Dr. Lisa Grant, Medicare Policy Analyst, Washington D.C.

“Check your plan’s drug formulary annually. A medication you need today might not be covered next year.”

— Robert Jenkins, Licensed Medicare Broker, Florida

How to Choose the Best Medicare Advantage Plan

When comparing plans, focus on your personal healthcare needs, not just the monthly premium.

- List your medications – Confirm coverage in the plan’s drug formulary.

- Check provider networks – Ensure your doctors and hospitals are in-network.

- Review extra benefits – Dental, vision, and wellness perks can add $500–$1,000 in yearly value.

- Assess out-of-pocket limits – Lower MOOP = higher protection.

- Consult an advisor or Medicare lawyer if unsure about plan terms.

Our 2025 Recommendations

- Best Overall Plan: UnitedHealthcare (AARP Medicare Advantage Choice)

- Best for Affordability: Humana Gold Plus HMO

- Best for Care Coordination: Kaiser Permanente Senior Advantage

- Best PPO Flexibility: Blue Cross Blue Shield

- Best for Low Drug Costs: Aetna Medicare Premier PPO

Choosing the best Medicare Advantage plan for seniors in 2025 doesn’t have to be overwhelming. With stable premiums, growing coverage networks, and new benefits focused on preventive care, it’s an excellent time for seniors to review their options.

From AARP UnitedHealthcare to Kaiser Permanente and Humana, today’s plans combine affordability with exceptional healthcare coordination. And with experienced Medicare lawyers and advisors available nationwide, seniors can feel confident knowing expert help is just a phone call away.

Stay informed with InsuranceDailyNews.org, your trusted source for Medicare, insurance, and retirement coverage updates for 2025 and beyond.

You May Also Like

💡 Texas Car Accident Claims: How to Find the Best Insurance Lawyer Near Me in 2025

Learn which Texas-based attorneys provide the strongest legal representation and highest claim success rates this year.

🚗 Dallas Auto Insurance Lawyers: Top Law Firms Specializing in Car Accident Settlements

Explore top-rated Dallas attorneys helping victims maximize compensation for vehicle damage and medical expenses.

⚖️ Should You Hire a Personal Attorney or Let the Insurance Company Handle Your Claim?

Discover the pros and cons of managing your car insurance claim independently versus hiring a legal expert.

🔥 Top 10 U.S. States with the Most Expensive Auto Insurance Premiums – 2025 Analysis

See how Texas ranks and what factors drive up insurance rates across the country.

3 thoughts on “U.S. Best Medicare Advantage Plans for Seniors 2025 Guide”