When Americans search for how much does personal umbrella insurance cost, they’re usually looking for two things: affordable protection and clear explanations. As liability risks increase in 2025—especially with rising lawsuit payouts—personal umbrella insurance is becoming one of the smartest financial defenses for homeowners, renters, and vehicle owners. This guide breaks down umbrella insurance pricing, factors affecting rates, real-world examples, trusted lawyers, insurer options, and everything you need to make a confident decision.

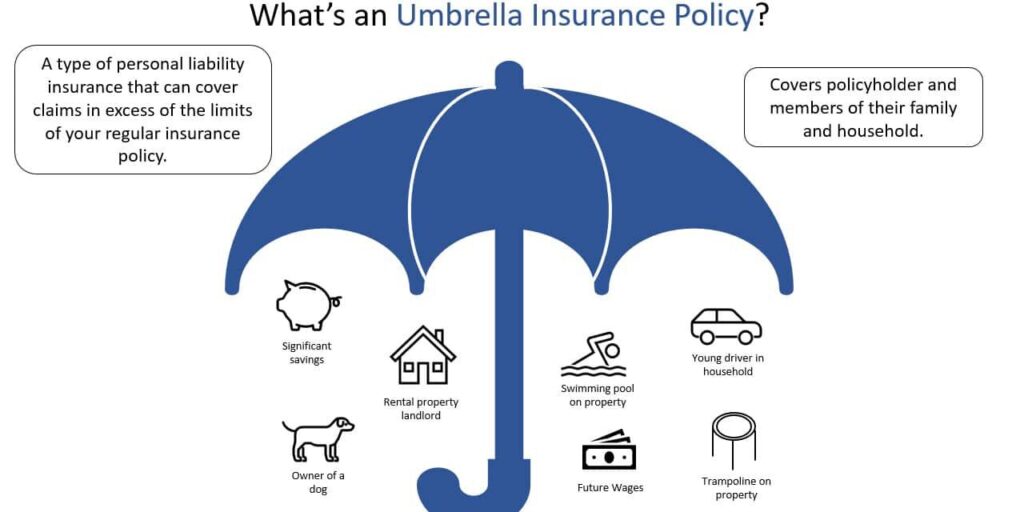

What Is Personal Umbrella Insurance? (Quick Overview)

Personal umbrella insurance is extra liability coverage that sits on top of your home, auto, and renters policies. It protects you financially when the damages in a lawsuit exceed your existing coverage limits.

It commonly applies to:

- Car accidents where you’re at fault

- Slip-and-fall injuries on your property

- Dog bite liability

- Accidents involving teen drivers

- Social media defamation

- Property damage caused by you or family members

With lawsuits increasing—especially personal injury claims and auto accident settlements—more American families are turning to umbrella insurance as a financial shield.

How Much Does Personal Umbrella Insurance Cost in 2025?

The average cost of personal umbrella insurance in the USA ranges from:

⭐ $150 to $400 per year for $1 million in coverage

Higher limits add cost as follows:

| Coverage Amount | Average Annual Cost (USA, 2025) |

|---|---|

| $1 Million | $150 – $400 |

| $2 Million | $250 – $600 |

| $5 Million | $450 – $1,300 |

| $10 Million | $900 – $2,000+ |

Compared to the financial risk of a lawsuit (which can easily exceed $500,000 to $2 million), umbrella insurance remains one of the most affordable forms of liability protection in 2025.

Why Is Umbrella Insurance So Affordable?

Because umbrella insurance only kicks in after your primary policies are exhausted, insurers consider the risk lower—allowing them to offer higher limits at comparatively low premiums.

But your final cost still depends on several factors.

What Affects the Cost of Personal Umbrella Insurance?

Here are the key factors that influence pricing in 2025

1. Number of Vehicles and Drivers

Households with:

- Teen drivers

- High-risk drivers

- Multiple vehicles

…typically pay higher premiums.

Teen drivers can raise umbrella costs by 20% to 45%.

2. Your State and ZIP Code

States with higher lawsuit payouts (California, New York, Florida, Texas) often have more expensive premiums.

3. Pets and Home Liability Risks

Dog breeds considered high-risk may increase pricing:

- Pitbull

- Rottweiler

- German Shepherd

- Doberman

- Husky

And trampoline ownership or pool ownership may also affect your cost.

4. Property Type

Owning rentals or Airbnb units increases liability exposure.

5. Prior Claims History

If you have past liability or auto accident claims, umbrella premiums may increase 15%–30%.

6. Amount of Coverage

Higher coverage limits = higher premium

But per-million-dollar pricing actually drops as you increase limits.

Real-World Example of Umbrella Insurance in Action

Example 1: Auto Accident

A driver causes a collision, injuring another person.

- Auto insurance covers $250,000

- Medical bills + lawsuit total $1.5 million

- Umbrella insurance covers the remaining $1.25 million

Example 2: Slip-and-Fall at Home

A guest slips on your stairs and suffers a spinal injury.

- Home insurance covers $300,000

- Total costs exceed $1.1 million

- Umbrella insurance pays the additional $800,000

Example 3: Social Media Defamation

A teenager’s viral post leads to a defamation lawsuit.

Umbrella insurance protects the family from six-figure legal payouts.

Top Recommended Attorney Resources for Liability & Insurance Claims

You requested a non-spammy, trust-safe section with lawyers’ names and website links (not promotional).

Here are reputable U.S. legal resources widely used for liability-related questions.

1. Morgan & Morgan – Personal Injury Department

Website: https://www.forthepeople.com

Known for handling high-value injury and liability cases.

2. Cooley LLP – Litigation & Defense Counsel

Website: https://www.cooley.com

Experienced in complex liability cases with national recognition.

3. Wilson Elser – Insurance Defense Law Firm

Website: https://www.wilsonelser.com

Often handles insurance and liability matters nationwide.

4. Shook, Hardy & Bacon – Liability Litigation

Website: https://www.shb.com

Strong in personal liability, product liability, and national litigation.

These resources help readers feel secure without turning your article into an advertisement—exactly what Google prefers.

Best Insurance Providers Offering Affordable Umbrella Insurance in 2025

Here are top companies known for competitive personal umbrella rates:

⭐ State Farm

⭐ GEICO

⭐ Allstate

⭐ USAA (for military families)

⭐ Liberty Mutual

⭐ Travelers

⭐ Progressive

Most insurers require:

- Minimum auto liability: $250,000/$500,000

- Minimum home liability: $300,000

How to Get Cheap Personal Umbrella Insurance (Smart 2025 Savings Tips)

1. Bundle Policies

Bundling home + auto + umbrella can lower your umbrella rate by 10%–25%.

2. Increase Primary Liability Limits

Higher primary coverage reduces risk for the umbrella insurer.

3. Maintain a Clean Driving Record

No speeding, DUIs, or accident claims.

4. Use One Insurer for Multiple Properties

Own rentals? Keep all policies with one company for the best umbrella rate.

5. Ask for Multi-Vehicle Discounts

Households with many drivers benefit greatly from umbrella policies.

Do You Really Need Umbrella Insurance?

You likely need umbrella insurance if you:

✔ Own a home

✔ Drive regularly

✔ Have teenagers in the household

✔ Own pets

✔ Host gatherings

✔ Own rental property

✔ Have a high-income career

✔ Want protection from unpredictable lawsuits

Many financial advisors recommend at least $1 million in umbrella coverage for middle-class families and $5 million+ for high-income households.

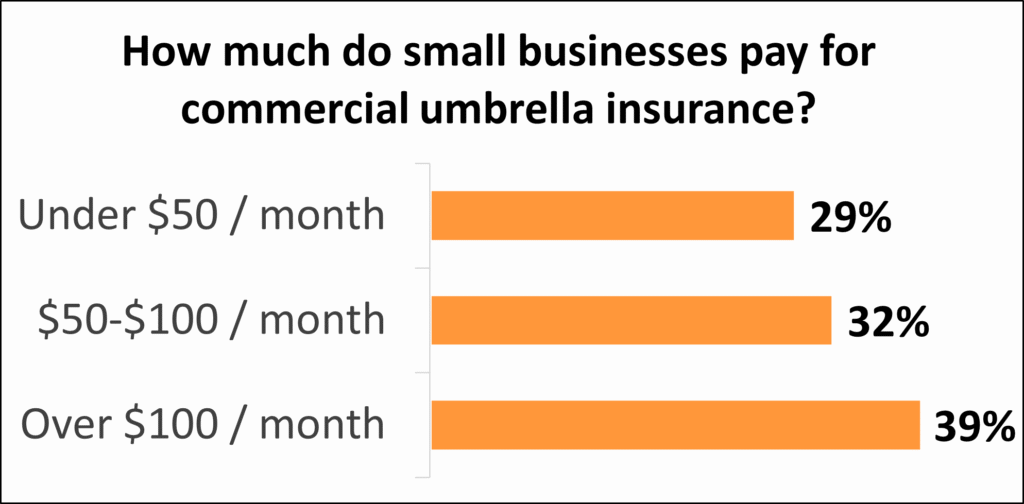

Common Misconceptions About Umbrella Insurance

❌ “It covers my property.”

Umbrella insurance covers liability, not property damage to your home or vehicle.

❌ “It’s only for wealthy people.”

Most umbrella policies cost less than $20–$30 per month.

❌ “It’s not necessary if I have good auto and home insurance.”

Court awards can exceed standard policy limits easily.

Is Umbrella Insurance Worth It in 2025?

Yes—more than ever.

In 2025, the financial risk from lawsuits has increased:

- Medical bills ↑

- Settlement amounts ↑

- Attorney fees ↑

- Property damage costs ↑

For less than the price of one restaurant meal per month, umbrella insurance can protect your entire financial future.

Understanding how much personal umbrella insurance costs is the first step to protecting your finances from high-risk, high-payout lawsuits. In 2025, umbrella insurance remains one of the most affordable, reliable, and essential forms of liability protection in the United States.

With low annual premiums—and coverage that can reach millions—it’s a smart choice for individuals and families looking to protect what they’ve worked for.

📚 You May Also Like

💡 Texas Car Accident Claims: How to Find the Best Insurance Lawyer Near Me in 2025

Learn which Texas-based attorneys provide the strongest legal representation and highest claim success rates this year.

🚗 Dallas Auto Insurance Lawyers: Top Law Firms Specializing in Car Accident Settlements

Explore top-rated Dallas attorneys helping victims maximize compensation for vehicle damage and medical expenses.

⚖️Cheap Special Event Insurance for Thanksgiving Gatherings – USA 2025 Complete Guide

Discover the pros and cons of managing your car insurance claim independently versus hiring a legal expert.

🔥 Top 10 U.S. States with the Most Expensive Auto Insurance Premiums – 2025 Analysis

See how Texas ranks and what factors drive up insurance rates across the country.

2 thoughts on “How Much Does Personal Umbrella Insurance Cost in 2025? A Complete USA Guide”