Homeowners across the United States are preparing for another year of rising insurance premiums. In 2025, the average homeowners insurance policy is expected to increase by 8% – 22%, depending on the state and risk profile. These rate hikes are driven by factors such as increased weather claims, rebuilding costs, inflation, and insurers exiting high-risk markets.

If you are a homeowner, staying informed is essential. This guide explains why rates are rising, which states are affected the most, how to lower your premiums, and when to seek professional legal support if your insurance company denies or underpays your claim.

Why Are Homeowners Insurance Rates Increasing in 2025?

1. Severe Weather and Climate Risk

Climate-related disasters—including hurricanes, wildfires, hailstorms, and flooding—have become more frequent and severe. Insurance carriers are paying more claims than in previous decades, leading to higher premiums to manage financial risk.

2. Higher Construction and Rebuilding Costs

Materials such as lumber, steel, roofing, and labor are more expensive. When repair costs go up, insurers adjust premiums to match the replacement value of homes.

3. Insurance Carriers Exiting High-Risk States

Some companies have reduced coverage or fully withdrawn from markets like:

- California (wildfires)

- Florida (hurricanes)

- Louisiana (storm surge)

- Texas (hail & storm clusters)

Less insurer competition → Higher prices for consumers.

4. Reinsurance Costs

Insurance companies also insure themselves. When reinsurance becomes more expensive, homeowners feel the impact in premium adjustments.

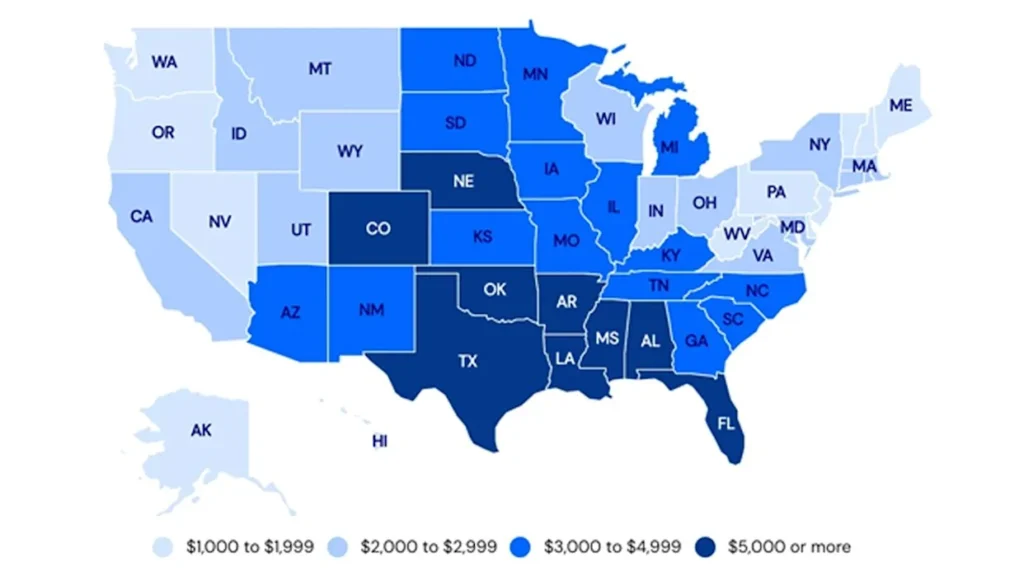

States Experiencing the Largest Home Insurance Rate Hikes in 2025

| State | Estimated Average Increase | Main Risk Factor |

|---|---|---|

| Florida | +20% to +34% | Hurricanes & insurer exits |

| Texas | +14% to +29% | Hail & wind events |

| California | +18% to +27% | Wildfires & market withdrawals |

| Colorado | +12% to +24% | Wildfire + hail patterns |

| Louisiana | +19% to +33% | Flooding & storm surge |

States less affected include: Ohio, Vermont, Maine, Pennsylvania, and Illinois.

How to Reduce Your Homeowners Insurance Costs in 2025

Even with rising rates, homeowners have options:

1. Increase Your Deductible

Raising your deductible from $500 → $1,000 could lower premiums by 5%–11%.

2. Bundle Home + Auto

Most insurers offer 8%–25% discounts when policies are bundled.

3. Install Home Safety Devices

Items that reduce claims risk may qualify for discounts:

- Smart smoke detectors

- Security cameras

- Roof reinforcements

- Storm shutters

4. Request a Re-Evaluation of Your Home’s Risk Score

If your home had roof upgrades or wildfire-proofing, you may qualify for lower rates — but only if you ask.

5. Shop and Compare Quotes Annually

Do not auto-renew without reviewing competing offers.

What If Your Insurance Claim Is Denied, Delayed, or Underpaid?

Homeowners often face issues such as:

- The insurer delays processing the claim

- The claim is undervalued

- The insurer denies coverage without proper reason

In these cases, insurance claim attorneys can help negotiate, escalate complaints, or litigate if necessary.

Below are reputable insurance claim law firms in the U.S. that assist homeowners:

| Attorney / Law Firm | Specialty | Website |

|---|---|---|

| Merlin Law Group (Chip Merlin) | Property insurance claim disputes, bad faith claims | https://www.merlinlawgroup.com |

| The Voss Law Firm, P.C. | Residential & commercial property damage claims | https://www.vosslawfirm.com |

| Kanner & Pintaluga | Storm, fire, and wind damage dispute representation | https://kpattorney.com |

| Morgan & Morgan – Insurance Claim Disputes Team | National law firm focused on denied/underpaid claims | https://www.forthepeople.com |

Tip: Always verify attorney licensing in your state.

How to File a Dispute If You Believe Your Rate Increase Is Unfair

You can:

- Contact your insurance company and request a premium justification letter.

- File a complaint with your State Department of Insurance.

- Consult an attorney if you believe the insurer is acting in bad faith.

Future Outlook: Will Homeowners Insurance Keep Rising?

Based on current trends, rate increases are expected to continue through 2026, especially in states with high:

- Wildfire risk

- Hurricane exposure

- Cost of rebuilding

However, states implementing insurance reform policies may stabilize rates.

The reality of homeowners insurance rate increases in 2025 is unavoidable, but homeowners can take strategic steps to protect their finances. By comparing insurers, improving home safety, appealing unfair decisions, and knowing when to speak with a legal expert, you can manage your insurance costs without sacrificing coverage.

📚 You May Also Like

💡 Homeowners Insurance Rate Increases in Texas 2025: A Practical Guide for Homeowners

Learn which Texas-based attorneys provide the strongest legal representation and highest claim success rates this year.

🚗 Homeowners Insurance Rate Increases in Louisiana 2025: A Clear Guide for Homeowners

Explore top-rated Louisiana attorneys helping victims maximize compensation for vehicle damage and medical expenses.

⚖️ Homeowners Insurance Rate Increases in Florida 2025: What Every Homeowner Needs to Know

Discover the pros and cons of managing your car insurance claim independently versus hiring a legal expert.

🔥 Homeowners Insurance Rate Increases in Oklahoma 2025: What Homeowners Should Expect

See how Oklahoma ranks and what factors drive up insurance rates across the country.

2 thoughts on “Homeowners Insurance Rate Increases 2025: What U.S. Homeowners Need to Know”