New York seniors are among the most Medicare-savvy in the nation — and for good reason. With rising hospital and outpatient care costs, finding the right Medicare Supplement Plan (Medigap) in 2025 is more important than ever.

This comprehensive guide breaks down the best Medicare Supplement Plans in New York for 2025, comparing costs, coverage, and insurer reputations. You’ll also find trusted lawyers and Medicare advisors to guide you through enrollment or coverage disputes — all tailored for New York residents.

What Are Medicare Supplement (Medigap) Plans?

Medicare Supplement Plans, also known as Medigap, are private insurance policies that fill the “gaps” left by Original Medicare (Parts A and B). These plans help pay for:

- Copayments and coinsurance

- Hospital and skilled nursing costs

- Part A & Part B deductibles

- Emergency medical care during foreign travel

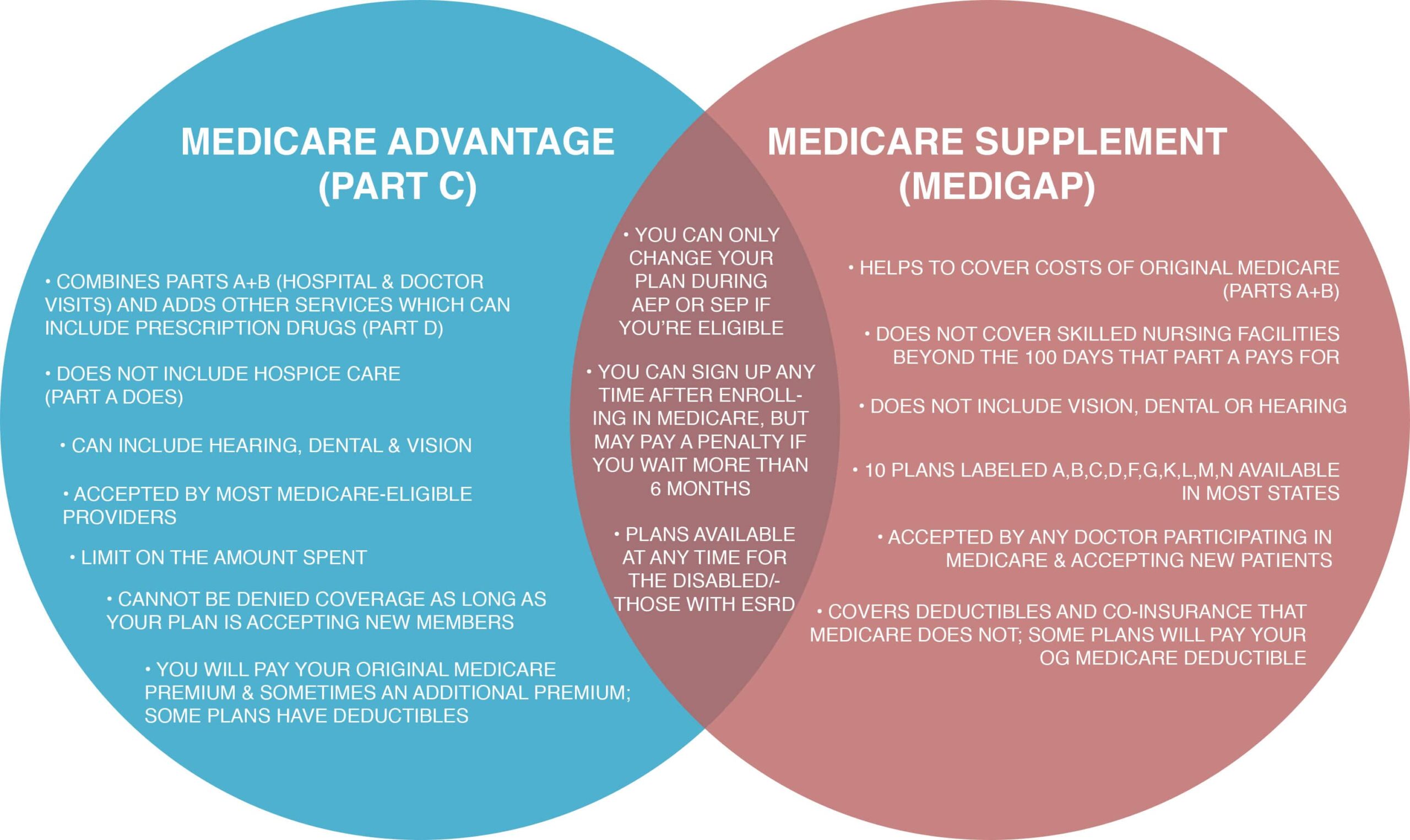

Unlike Medicare Advantage, Medigap plans don’t replace your Original Medicare — they enhance it by minimizing out-of-pocket costs.

Why Compare Medicare Supplement Plans in 2025?

Medicare rules and premiums change annually. In 2025, New York’s Department of Financial Services (DFS) has approved several updated Medigap rate filings from major insurers.

Here’s why comparing plans this year is critical:

- New 2025 premium rates – Many carriers increased rates by 3–5%.

- Emerging insurers – NewMedicare and AmeriLife entered the NY market.

- Coverage stability – Plan G and N continue to dominate.

- Guaranteed issue laws – New York uniquely allows you to switch Medigap plans year-round without medical underwriting.

That last point makes New York one of the most consumer-friendly states for Medicare coverage — no other U.S. state offers such flexibility.

Best Medicare Supplement Plans in New York for 2025

| Plan | Coverage Level | Best For | Average Monthly Premium (NY) |

|---|---|---|---|

| Plan G | ★★★★★ | Full coverage seekers | $225 – $270 |

| Plan N | ★★★★☆ | Budget-conscious seniors | $180 – $230 |

| High-Deductible G | ★★★☆☆ | Low monthly cost | $80 – $110 |

| Plan F | ★★★★★ | Pre-2020 beneficiaries | $250 – $310 |

| Plan K & L | ★★★☆☆ | Partial coverage | $130 – $180 |

Pro Tip: In New York, Plan G continues to offer the best long-term value in 2025. Its predictable out-of-pocket costs make it ideal for retirees who prefer comprehensive protection.

Top Medicare Supplement Insurance Providers in New York (2025)

1. Empire BlueCross BlueShield

🌐 www.empireblue.com

Empire offers competitive Plan G and Plan N options with access to New York’s largest hospital network and a reputation for stable renewals.

2. Aetna Medicare Supplement New York

🌐 www.aetna.com/medicare

Known for digital enrollment tools and household discounts, Aetna continues to expand across the five boroughs and upstate regions.

3. Mutual of Omaha

🌐 www.mutualofomaha.com

Offers high-quality Plan G coverage with steady rates and superior customer satisfaction.

4. Cigna Healthcare

🌐 www.cigna.com/medicare

Cigna’s simple claims process and transparent billing make it a go-to choice for retirees in Long Island, Albany, and Buffalo.

5. UnitedHealthcare (AARP Plans)

🌐 www.uhc.com/medicare

Underwritten by AARP, UHC provides extensive nationwide provider access — perfect for seniors who travel between states.

Legal & Advisory Experts for Medicare in New York

Medicare regulations can be confusing, especially if you face billing disputes, plan changes, or denial of coverage. Here are top-rated lawyers and advisory services in New York specializing in Medicare and senior benefits:

- Cona Elder Law (Melville, NY)

🌐 www.conaelderlaw.com

Specializes in elder law, Medicare appeals, and long-term care planning. - The Law Offices of Ronald Fatoullah & Associates (New York City, NY)

🌐 www.fatoullahlaw.com

Provides senior benefits counseling, Medicare rights advocacy, and asset protection. - New York Legal Assistance Group (NYLAG)

🌐 www.nylag.org

Nonprofit offering free legal aid for Medicare denials and elder healthcare disputes. - Medicare Rights Center (National, NYC-based)

🌐 www.medicarerights.org

Renowned nonprofit specializing in Medicare appeals and policy advocacy, headquartered in New York City.

These experts help seniors appeal coverage denials, resolve billing conflicts, and navigate changes in federal or state Medicare policy.

Enrollment Rules in New York for Medigap Plans

Unlike most states, New York allows continuous Medigap enrollment. You can switch or enroll in any Medicare Supplement Plan at any time during the year, regardless of health history.

That means:

✅ No medical underwriting

✅ Guaranteed acceptance

✅ Freedom to change carriers

This “open enrollment all year” policy is one of the biggest advantages for New York retirees, ensuring flexibility and financial security.

How Much Do Medigap Plans Cost in New York in 2025?

Here’s a look at the average monthly Medigap rates across New York’s major cities:

| City | Plan G Avg. Premium | Plan N Avg. Premium |

|---|---|---|

| New York City | $265 | $225 |

| Albany | $240 | $210 |

| Buffalo | $230 | $200 |

| Rochester | $235 | $205 |

| Long Island | $260 | $220 |

(Rates based on 65-year-old non-smoker, as of January 2025.)

Expert Insights from New York Advisors

“New York’s community-rated structure means everyone pays the same Medigap premium regardless of age. That’s a big win for older seniors who enroll later.”

— Michael Feldman, Certified Medicare Advisor, Brooklyn

“Switching plans in New York is easier than anywhere else. The key is comparing renewal histories and customer service ratings.”

— Laura Sanchez, Medicare Consultant, Rochester

How to Save Money on Medigap in New York

Here are actionable strategies for cutting your 2025 Medicare Supplement costs:

- Compare multiple insurers – Premiums vary up to 30% for identical coverage.

- Avoid over-insuring – Plan N may save $40–60 monthly versus Plan G if you rarely visit doctors.

- Use household discounts – Many carriers offer up to 7% off.

- Consult a Medicare advisor – Experts often uncover discounts not advertised publicly.

- Review coverage annually – Switching during a stable renewal cycle can save hundreds yearly.

Step-by-Step: How to Compare Plans

- List your 2025 healthcare needs – Include prescriptions and doctor visits.

- Check which plans your providers accept – Confirm Medicare participation.

- Get quotes from at least three insurers.

- Review financial stability and complaint ratios.

- Consult a Medicare lawyer or advisor before finalizing.

By following this checklist, New York seniors can make informed choices while minimizing financial surprises.

Best Plan Recommendations for 2025

- Best Overall Coverage: Plan G (Empire BlueCross or Mutual of Omaha)

- Best for Affordability: Plan N (Aetna or Cigna)

- Best for Healthy Seniors: High-Deductible Plan G (UHC or Aetna)

- Best Customer Support: AARP/UHC Plans

You May Also Like

💡 Compare Medicare Supplement Plans Texas 2025: The Complete Guide for Seniors

Learn which Texas-based attorneys provide the strongest legal representation and highest claim success rates this year.

🚗 Compare Medicare Supplement Plans Florida 2025: Expert Guide for Seniors

Explore top-rated Florida attorneys helping victims maximize compensation for vehicle damage and medical expenses.

⚖️Compare Medicare Supplement Plans California 2025: Your Complete Guide to Choosing the Right Medigap Coverage

Discover the pros and cons of managing your car insurance claim independently versus hiring a legal expert.

🔥 US Compare Medicare Supplement Plans 2025: Your Complete Guide to Choosing the Best Medigap Coverage

See how U.S. ranks and what factors drive up insurance rates across the country.

2 thoughts on “Compare Medicare Supplement Plans New York 2025: The Ultimate Guide for Seniors”