As healthcare expenses continue to rise across the Sunshine State, Florida seniors are turning to Medicare Supplement (Medigap) Plans to manage costs and gain peace of mind.

With 2025 bringing premium adjustments, plan structure updates, and new insurer entries, it’s the ideal time to compare Medicare Supplement Plans Florida 2025 to find the most affordable and reliable coverage.

This in-depth guide breaks down everything you need to know — plan comparisons, premium trends, insurer ratings, and even legal experts who help Floridians protect their Medicare rights.

Understanding Medicare Supplement (Medigap) Plans

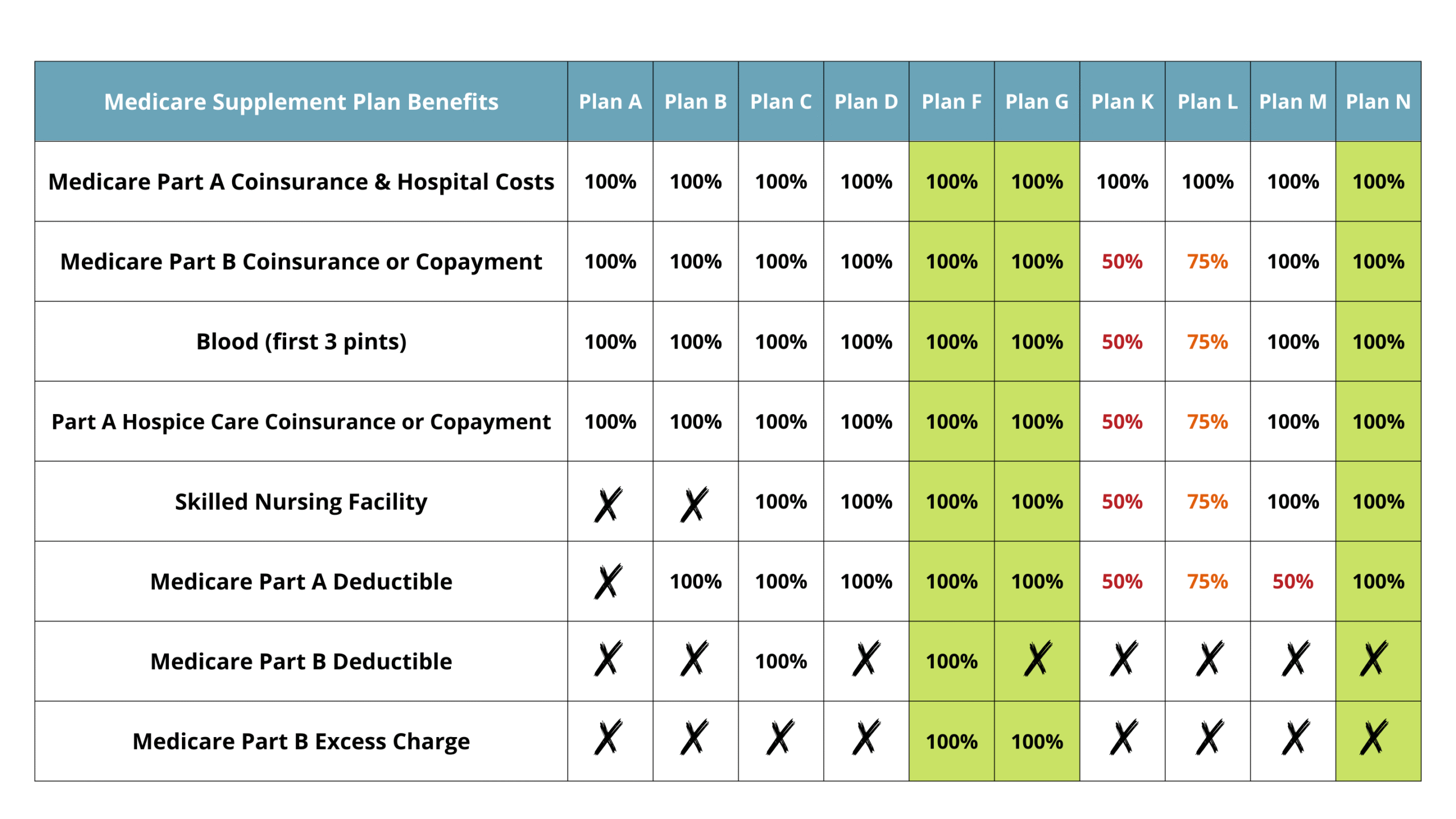

Medicare Supplement Plans, often called Medigap, are private insurance policies that cover the out-of-pocket expenses not paid by Original Medicare (Part A and Part B) — such as:

- Copayments and coinsurance

- Hospital deductibles

- Excess physician charges

- Foreign travel emergency coverage

While the benefits for each plan are standardized by the federal government, pricing and additional perks vary among insurers in Florida.

For 2025, the most popular plans remain Plan G and Plan N, offering the best balance between coverage and cost.

Why Comparing Medicare Supplement Plans in 2025 Is Important

In 2025, Florida’s Medigap market continues to grow, with over 2.2 million Medicare beneficiaries — one of the largest in the U.S.

Each year, insurance carriers adjust their Medigap premiums based on inflation, claims experience, and local healthcare costs. According to the Florida Office of Insurance Regulation, the average statewide rate increase in 2025 is:

- Plan G: +6.1%

- Plan N: +4.7%

- High-Deductible G: +2.2%

Comparing plans annually ensures you don’t overpay — some Floridians save up to $900 per year by switching providers without losing benefits.

Top Medicare Supplement Plans in Florida (2025)

Here’s how the major Medigap plans compare in 2025:

| Plan | Coverage Level | Ideal For | Average Monthly Premium (FL) |

|---|---|---|---|

| Plan G | ★★★★★ | Most new enrollees | $150 – $190 |

| Plan N | ★★★★☆ | Healthy retirees | $120 – $160 |

| Plan F | ★★★★★ | Pre-2020 enrollees | $180 – $250 |

| High-Deductible G | ★★★☆☆ | Low premium seekers | $60 – $80 |

| Plan K & L | ★★★☆☆ | Partial coverage | $70 – $130 |

Tip: Florida residents turning 65 in 2025 should prioritize Plan G — it offers near-complete coverage with predictable annual costs.

Top Medicare Supplement Insurance Providers in Florida (2025)

Here are the most trusted Medigap insurance carriers serving Florida seniors this year:

1. Florida Blue (Blue Cross and Blue Shield of Florida)

🌐 www.floridablue.com

Florida Blue offers Plan G and Plan N with low renewal rate increases and access to the state’s largest hospital network.

2. Aetna Medicare Supplement Florida

🌐 www.aetna.com/medicare

Aetna remains popular for its digital tools, household discounts, and customer-first claims process.

3. Cigna Healthcare

🌐 www.cigna.com/medicare

Cigna’s strong reputation for transparency and reliable Plan G pricing makes it a leading choice for retirees in Miami, Tampa, and Orlando.

4. UnitedHealthcare (AARP Medigap Plans)

🌐 www.uhc.com/medicare

Backed by AARP, UHC provides nationwide network access and predictable premium stability — perfect for snowbirds and retirees who travel.

5. Mutual of Omaha

🌐 www.mutualofomaha.com

Known for financial strength and excellent member service, Mutual of Omaha’s Plan G remains among the best-rated plans in Florida.

Legal & Advisory Experts for Medicare in Florida

Navigating Medigap rules, claims, or disputes can be complex. These Florida-based legal professionals and organizations specialize in Medicare rights and elder care:

- The Law Office of Amy B. Van Fossen, P.A. (Melbourne, FL)

🌐 www.amybvanfossen.com

Focuses on elder law, Medicare disputes, and estate planning for Florida retirees. - Florida Senior Legal Helpline

🌐 www.floridalegal.org

Provides free assistance on Medicare billing issues and plan denials. - Elder Law Associates PA (Boca Raton, FL)

🌐 www.elderlawassociates.com

A trusted resource for Medicare appeals, long-term care, and senior insurance planning. - Medicare Rights Center

🌐 www.medicarerights.org

National nonprofit offering legal advocacy and guidance on Medigap and SSA claims.

How to Save on Florida Medicare Supplement Premiums

Here’s how Floridians can keep their Medigap premiums manageable in 2025:

- Compare at least 3 insurers — prices can differ up to 25% for the same plan.

- Look for household discounts — many insurers offer 5–7% savings.

- Review annually — new entrants often undercut older carriers.

- Work with a Medicare agent or lawyer — they can find cost-efficient alternatives you might miss.

- Avoid unnecessary add-ons that inflate premiums.

2025 Florida Medicare Premium Snapshot

| City | Plan G Avg. Premium | Plan N Avg. Premium |

|---|---|---|

| Miami | $180 | $150 |

| Tampa | $165 | $140 |

| Orlando | $160 | $135 |

| Jacksonville | $155 | $130 |

| Tallahassee | $150 | $125 |

(Rates based on 65-year-old non-smokers, as of Q1 2025.)

Expert Opinion: Florida Advisors Speak

“The key to saving money in 2025 isn’t just finding the cheapest plan — it’s picking a company with stable renewal rates.”

— Mark Rivera, Medicare Advisor, Fort Myers Medicare Hub

“Many Florida retirees travel part-time; choosing nationwide carriers like Aetna or UHC ensures uninterrupted coverage.”

— Sandra Williams, Medicare Law Specialist, Tampa

Choosing the Right Plan for You

- Plan G: Best for those who want nearly full coverage and minimal surprises.

- Plan N: Perfect for retirees with few medical visits and lower budgets.

- High-Deductible G: Great for healthy, active seniors who rarely visit doctors.

- Plan F: Only available for those eligible before 2020 — still top-tier coverage.

Your decision should reflect your budget, lifestyle, and medical history — not just the lowest monthly cost.

Comparing Medicare Supplement Plans Florida 2025 is the smartest way to control healthcare expenses and safeguard your retirement savings.

With so many insurers and rate adjustments, Floridians should review their Medigap options each year — especially before their open enrollment period ends.

From trusted carriers like Florida Blue, Aetna, and Cigna, to legal advisors specializing in Medicare law, you have every resource available to make confident, informed decisions.

Stay connected with InsuranceDailyNews.org for the latest Medicare updates, cost comparisons, and trusted insights tailored to Florida’s seniors in 2025 and beyond.

You May Also Like

💡Compare Medicare Supplement Plans New York 2025: The Ultimate Guide for Seniors

Learn which New York-based attorneys provide the strongest legal representation and highest claim success rates this year.

🚗 Compare Medicare Supplement Plans Texas 2025: The Complete Guide for Seniors

Explore top-rated U.S. attorneys helping victims maximize compensation for vehicle damage and medical expenses.

⚖️US Compare Medicare Supplement Plans 2025: Your Complete Guide to Choosing the Best Medigap Coverage

Discover the pros and cons of managing your car insurance claim independently versus hiring a legal expert.

🔥Compare Medicare Supplement Plans California 2025: Your Complete Guide to Choosing the Right Medigap Coverage

See how U.S. ranks and what factors drive up insurance rates across the country.

One thought on “Compare Medicare Supplement Plans Florida 2025: Expert Guide for Seniors”