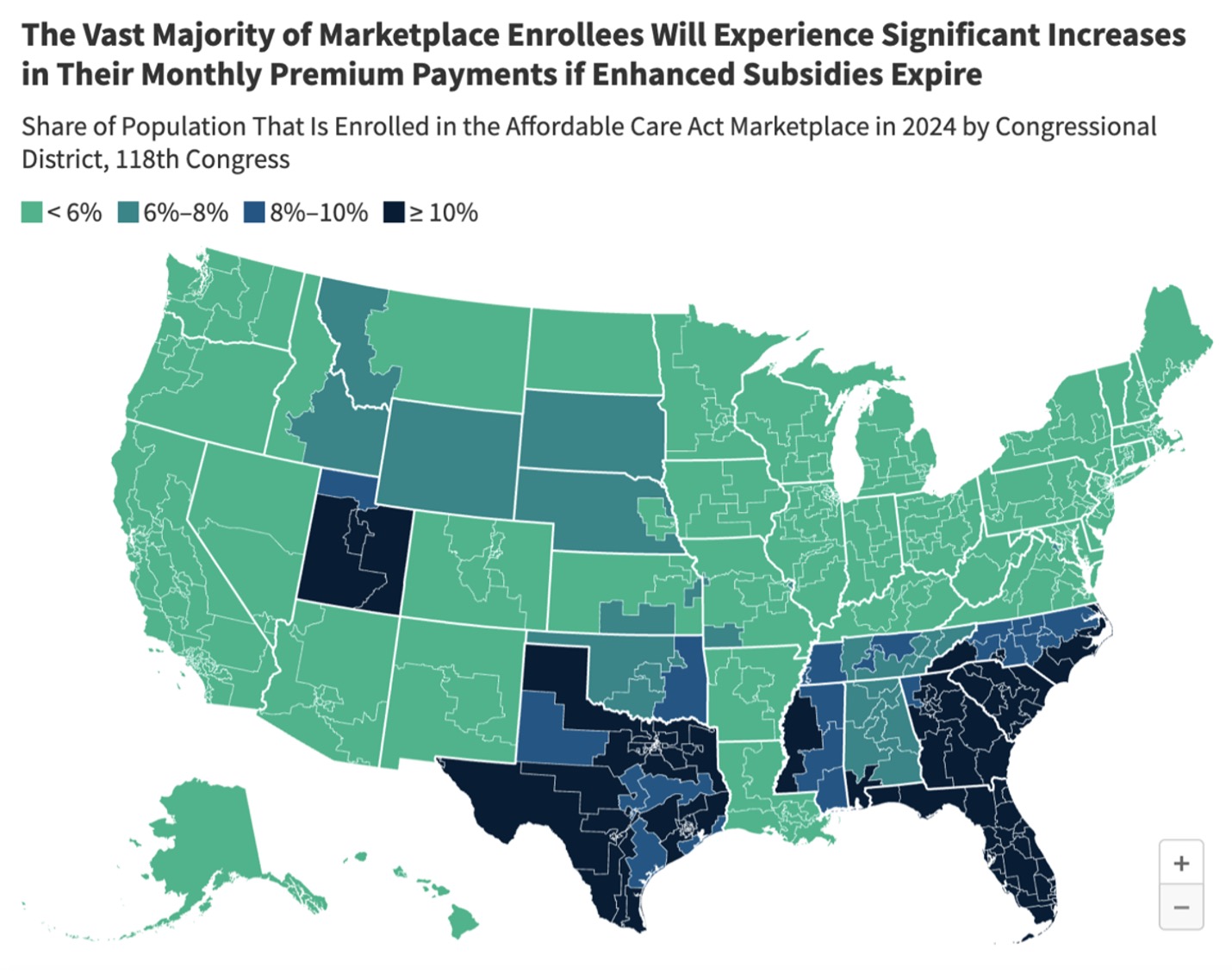

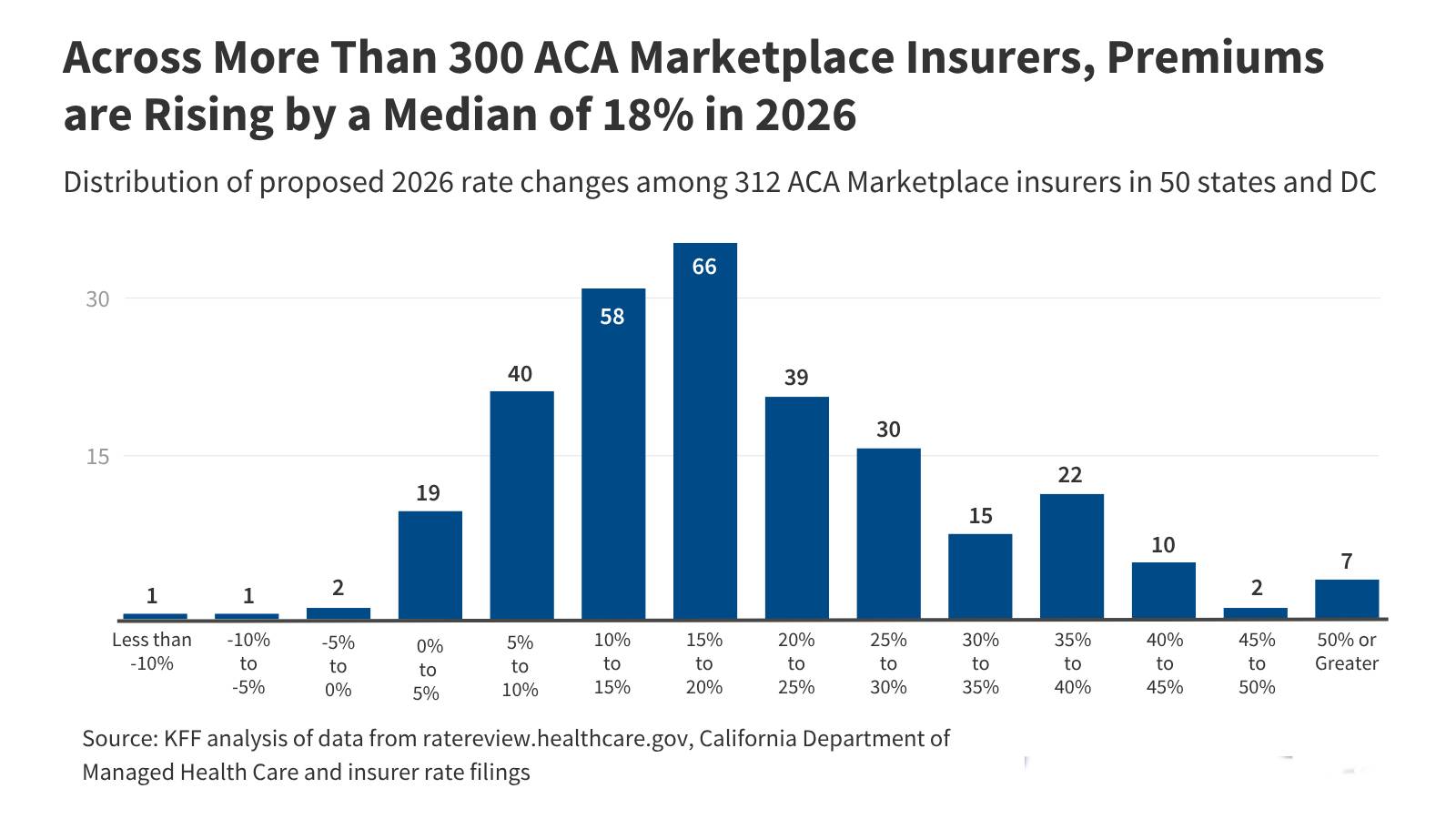

ACA Premium Spikes in 2026 are hitting millions of Americans hard as enhanced Affordable Care Act (ACA) subsidies expire on December 31, 2025, leading to sharp increases in out-of-pocket costs and many opting to drop coverage altogether. According to the Kaiser Family Foundation (KFF), subsidized enrollees’ average annual premium payments…

The Surge in Health Insurance Premiums: Navigating the 2026 Crisis in the USA

In the closing days of 2025, millions of Americans are grappling with the impending surge in health insurance premiums as enhanced subsidies under the Affordable Care Act (ACA) are set to expire on December 31. This policy shift, combined with broader economic pressures and insurer adjustments, is poised to reshape…

US Car Insurance Profitability 2025: A Comprehensive Analysis

In the landscape of US car insurance profitability 2025, the market is demonstrating signs of steadying after years of turbulence. Recent data highlights a significant improvement in personal auto combined ratios, dropping from over 112% in 2022 to around 95% in 2025, reflecting a shift toward underwriting profitability. This recovery…

Workers Compensation for Seasonal Farm Laborers in the USA: 2025 Complete Guide

Workers compensation for seasonal farm laborers is one of the most misunderstood and under-utilized coverages in American agriculture. Every year, thousands of U.S. farms hire H-2A workers, local high school students, harvest crews, and migrant laborers to pick fruit, detassel corn, bale hay, or run packing lines — yet many…

Best Agricultural Insurance for Organic Farms in the USA: 2025 Expert Guide

Finding the best agricultural insurance for organic farms in the United States is dramatically different from insuring a conventional row-crop operation. Organic farmers face unique risks — higher input costs, stricter certification rules, transitional acreage vulnerabilities, contamination threats, and premium price volatility — that most standard farm policies either exclude…

Does Crop Insurance Cover Flood Risks in Midwest? The Complete 2025 USA Guide

Does crop insurance cover flood risks in Midwest states like Iowa, Illinois, Nebraska, Missouri, and Minnesota? This is the #1 question Midwest farmers ask every spring as snow melts and rivers swell. The short answer is: It depends entirely on which type of crop insurance you bought. While standard Multi-Peril…

Cheap Equipment Insurance for Harvest Season: Protect Your U.S. Farm Machinery Without Breaking the Bank

Cheap equipment insurance for harvest season is one of the smartest investments American farmers can make as fall approaches. Harvest is the most intense, high-stakes period of the year — combines, grain carts, tractors, and augers run around the clock, often in muddy fields, at night, and under extreme pressure…

Farm Liability Insurance for Agritourism Businesses: Essential Protection for U.S. Farmers

Farm liability insurance for agritourism businesses is a critical safeguard for farmers across the USA who open their properties to the public for recreational and educational activities. As agritourism continues to grow in popularity, offering experiences like pumpkin patches, hayrides, farm tours, and pick-your-own produce, the need for comprehensive coverage…

What Is Revenue Protection Crop Insurance? A Complete Guide for American Farmers in 2025

If you’re a U.S. farmer asking yourself, “What is revenue protection crop insurance?”, you’re already on the right track to protecting your operation from one of the biggest risks in modern agriculture: volatile commodity prices combined with unpredictable yields. Revenue Protection (RP) is the most popular federally subsidized crop insurance…

Understanding the Crop Insurance Claims Process for Drought Damage in the USA

Drought is one of the most devastating natural disasters for farmers across the United States, wiping out yields and threatening livelihoods. If you’re a farmer dealing with parched fields and withered crops, navigating the crop insurance claims process for drought damage can be your lifeline to financial recovery. In this…