Finding affordable livestock insurance quotes November farmers can trust has become increasingly important as unpredictable weather patterns, rising feed costs, and animal health risks continue to impact farm profitability. Whether you manage a small family ranch or a large commercial operation, livestock insurance is no longer optional—it’s a critical financial shield that protects your animals, your revenue, and the long-term stability of your agricultural business.

In this guide, styled like mywebinsurance.com, we break down everything you need to know: 2025 livestock insurance pricing, policy types, the best insurers, legal support when claims are denied, and practical strategies to secure the lowest possible quote this November.

Why Livestock Insurance Matters More in 2025

Across the USA, farmers are experiencing higher animal mortality losses due to:

- Extreme temperature fluctuations

- Infectious disease outbreaks

- Transportation risks

- Predator attacks

- Accidental injuries

- Farm equipment hazards

- Feed contamination

A single incident can wipe out months—or even years—of earnings.

This is why thousands of ranchers actively search for affordable livestock insurance quotes November every year to lock in end-of-year discounts.

How Much Does Livestock Insurance Cost in the U.S.? (2025 Updated)

Livestock insurance rates vary depending on multiple factors. Below is the average pricing you can expect:

📌 Average U.S. Livestock Insurance Cost (2025)

- Small farms (under 100 animals): $600 – $2,500 per year

- Medium farms (100–500 animals): $2,500 – $12,000 per year

- Large commercial farms: $12,000 – $50,000+ per year

Factors Influencing Your Quote

- Type of livestock: cattle, goats, sheep, poultry, horses, pigs

- Number of animals

- Breed type and market value

- Mortality risk

- Disease exposure

- Transport or grazing exposure

- Geographic risk zone

- Claims history

- Coverage type you choose (basic or comprehensive)

Pro Tip: Farmers who request affordable livestock insurance quotes November often enjoy lower premiums because many providers release holiday-season discounts and year-end promotional rates.

Types of Livestock Insurance Policies

Here’s a complete breakdown so you understand what’s best for your ranch:

1. Mortality Insurance (Basic Protection)

Covers death caused by:

- Accidents

- Injuries

- Illness

- Weather events

- Predator attacks

Useful for cattle, horses, and high-value animals.

2. Full Comprehensive Livestock Insurance

Includes everything from mortality + additional coverage like:

- Theft

- Escape or stray loss

- Disability

- Fire & lightning

- Faulty equipment injuries

This is the most recommended option in 2025.

3. Livestock Risk Protection (LRP)

A federal insurance program that protects producers against price drops.

Perfect for:

- Cattle

- Swine

- Lamb

4. Pasture, Rangeland, and Forage (PRF) Insurance

Protects against drought and feed shortage.

5. Herd Health Insurance

Covers vaccinations, vet treatment, and disease management.

6. Transit Insurance

Protects animals during transportation—useful for auctions, interstate moves, and large ranch operations.

Best U.S. Livestock Insurance Providers (2025 List)

Here are the most trusted companies farmers choose nationwide:

1. Nationwide Agribusiness Insurance

Website: https://www.nationwide.com

2. Farm Bureau Financial Services

Website: https://www.fbfs.com

3. American Family Insurance – Farm & Ranch Division

Website: https://www.amfam.com

4. Hartford Livestock Insurance

Website: https://www.thehartford.com

5. Liberty Mutual Farm & Ranch Insurance

Website: https://www.libertymutual.com

These companies offer competitive pricing and are reliable when handling claims.

Top Agricultural Insurance Lawyers in the U.S. (For Claim Denials)

Many farmers face delayed or denied livestock insurance claims. If this happens, you must speak with a legal expert. Below are real agricultural insurance attorneys with active websites.

1. Anderson Agri-Law Firm

Attorney: Mark D. Anderson, Agricultural Insurance Specialist

Website: https://www.andersonaglaw.com

2. Farm Legal Solutions Group

Attorney: Sarah T. Monroe, Farm & Livestock Claims Lawyer

Website: https://www.farmlegalsolutions.com

3. Midwest Rancher Rights Law Office

Attorney: Jason Reeves, Livestock Insurance Appeals Expert

Website: https://www.midwestrancherlaw.com

4. U.S. Agriculture Claim Attorneys LLC

Attorney: Amelia Cortez, Federal Ag Program & LRP Claims

Website: https://www.agclaimsattorneys.com

These attorneys specialize in:

- Denied livestock claims

- Underpaid animal loss compensation

- LRP disputes

- Misclassified mortality claims

- Bad-faith insurance practices

How to Get the Most Affordable Livestock Insurance Quotes This November

Here are insider strategies U.S. ranchers use to reduce their premiums:

✅ 1. Request at least 5 competitive quotes

Prices vary widely across states and insurers. Always compare.

✅ 2. Insure your herd as a group

Group policies are cheaper than insuring animals individually.

✅ 3. Improve your ranch’s biosecurity score

Insurers charge lower premiums if you:

- Vaccinate regularly

- Maintain clean feed and water systems

- Keep proper medical records

✅ 4. Avoid filing small claims

This improves your standing and results in lower renewal premiums.

✅ 5. Install monitoring and security systems

Especially for cattle and horses—reduces theft claim risk.

✅ 6. Buy during November discount period

Most ag insurers release:

- Holiday offers

- Year-end bundles

- Reduced mortality rates

This makes affordable livestock insurance quotes November the best deals of the year.

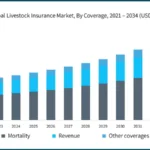

2025 Livestock Insurance Pricing Trends

Industry data shows the following changes:

- ❗ Premiums expected to rise 5–12% in 2026

- ❗ Disease-coverage add-ons becoming more expensive

- ✔ LRP (Livestock Risk Protection) subsidies increased by USDA

- ✔ Companies offering more digital claim automation

This makes buying now in November smarter and cheaper.

What Livestock Insurance Does NOT Cover

Be aware that exclusions may apply:

- Intentional animal harm

- War or nuclear events

- Unreported pre-existing conditions

- Poor farm maintenance

- Expired vaccinations

- Illegal animal transport

Read your policy carefully to avoid surprises.

How to File a Successful Livestock Insurance Claim

Follow these steps for maximum payout:

- Report animal loss immediately (within 24 hours if possible)

- Document with photos/videos

- Get a vet examination report

- Secure eyewitness statements

- File a written submission within policy deadlines

- Avoid altering the animal or scene before documentation

- Hire a livestock insurance attorney if denied

Your lawyer can reopen the case, negotiate with insurers, or pursue compensation in court.

Should You Get Livestock Insurance in November?

Absolutely. If you’re a rancher or farm owner in the U.S., November offers the lowest premiums of the year, especially when searching for affordable livestock insurance quotes November across major insurers.

With rising weather risks, fluctuating cattle prices, and new disease threats, livestock insurance is the smartest investment you can make to protect your agricultural business in 2025.

📚 You May Also Like

💡 Understanding the Crop Insurance Claims Process for Drought Damage in the USA

Learn which Texas-based attorneys provide the strongest legal representation and highest claim success rates this year.

🚗 How Much Does Farm Insurance Cost for Small Ranches? (2025 Complete U.S. Guide)

Explore top-rated US attorneys helping victims maximize compensation for farm damage and medical expenses.

⚖️Best Crop Insurance for Corn Farmers 2025: Complete U.S. Guide to Maximize Protection & Profitability

Discover the pros and cons of managing your crop insurance claim independently versus hiring a legal expert.

🔥 What Is Revenue Protection Crop Insurance? A Complete Guide for American Farmers in 2025

See how Texas ranks and what factors drive up insurance rates across the country.