In the closing days of 2025, millions of Americans are grappling with the impending surge in health insurance premiums as enhanced subsidies under the Affordable Care Act (ACA) are set to expire on December 31. This policy shift, combined with broader economic pressures and insurer adjustments, is poised to reshape the landscape of healthcare affordability across the nation. As premiums potentially double for many enrollees, the ripple effects could lead to higher uninsured rates, increased financial strain on families, and a reevaluation of how the U.S. addresses healthcare access in an era of rising costs.

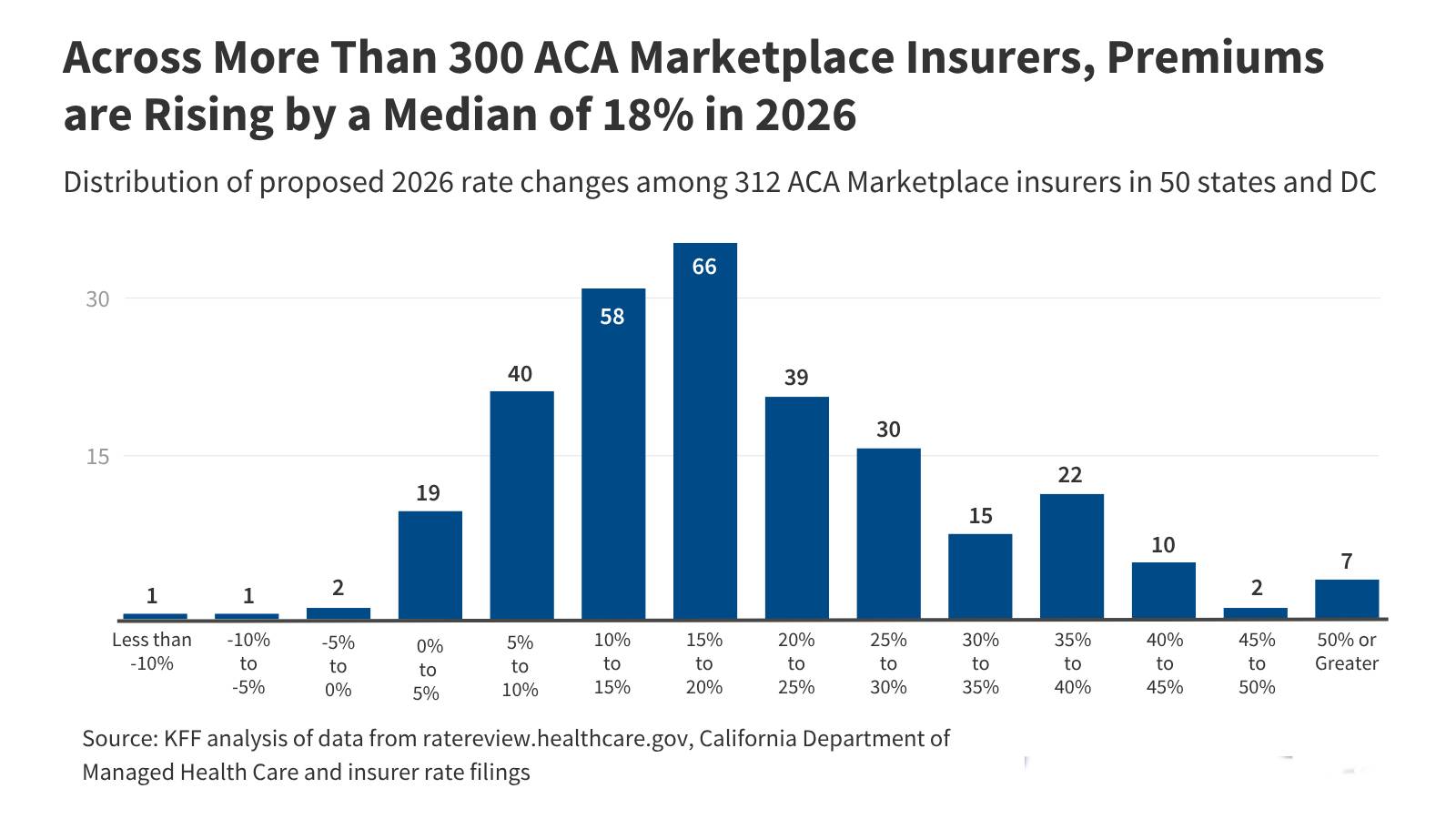

The expiration of these enhanced premium tax credits, originally expanded during the COVID-19 pandemic through the American Rescue Plan Act and extended by the Inflation Reduction Act, marks a pivotal moment in U.S. health policy. Enacted to make coverage more accessible, these subsidies reduced out-of-pocket premiums for millions, particularly those in middle-income brackets. Without renewal, the Congressional Budget Office (CBO) estimates that premiums for subsidized marketplace plans could rise sharply, with some households facing increases of up to 114% when factoring in insurer rate hikes.

This isn’t just a statistic; it translates to real-world impacts, such as an average annual premium jumping from $888 to $1,904 for many enrollees.

Women, who often shoulder the responsibility of managing family health decisions, are particularly affected as they navigate these escalating costs amid other economic pressures like inflation and childcare.

Enrollment data from the Centers for Medicare & Medicaid Services (CMS) underscores the severity of the situation. For 2026, ACA marketplace sign-ups have dipped to approximately 15.6 million, a decline from the 16 million recorded in 2025.

CMS Administrator Mehmet Oz highlighted this trend, attributing it to the subsidy cliff.

A Kaiser Family Foundation (KFF) poll reveals that 25% of current enrollees might forgo coverage if premiums double, exacerbating the uninsured rate that had been steadily declining.

This could disproportionately impact lower- and middle-income families ineligible for Medicaid, potentially reversing years of progress in reducing the uninsured population from over 44 million in 2013 to around 27 million today.

Politically, the subsidy expiration has sparked intense debate in Congress. Republicans, who control both chambers, have resisted extending the enhancements, viewing them as temporary pandemic measures that balloon federal spending.

No last-minute legislative fix materialized before year-end, leading to gridlock.

Alternatives like short-term limited-duration plans or health savings accounts have been floated, but critics label some as “junk insurance” due to inadequate protections for pre-existing conditions.

Experts suggest possibilities for retroactive relief or special enrollment periods in 2026, though nothing is guaranteed.

Meanwhile, states like Texas may offer some buffer through mechanisms like “silver loading,” where insurers adjust premiums to maintain affordability for subsidized plans, potentially keeping costs lower without federal aid.

Beyond health insurance, the property and casualty sector faces its own turmoil, driven largely by climate change. Homeowners insurance premiums have surged 58% nationwide since 2018, with availability shrinking in high-risk states.

California, Florida, Texas, and Louisiana are ground zero, where insurers are non-renewing policies or exiting markets altogether due to escalating wildfire, hurricane, and flood risks.

For instance, in Florida, reforms in 2022 and 2023 have stabilized the market somewhat, with 18 new or relaunched insurers entering and improved solvency metrics reported by ALIRT Insurance Research.

Yet, global catastrophe losses for 2025 are projected at $107 billion, more than double the first half of 2024’s figures.

Climate experts link these trends to intensifying extreme weather events. A Yale Climate Connections report notes that President Trump’s anti-climate policies, including tariffs and funding cuts, could accelerate premium hikes by double digits. Tariffs on construction materials alone might inflate rebuilding costs, pushing insurance rates up 38% faster by year’s end.

In one stark period from 2018-2023, insurers canceled nearly 2 million homeowners’ policies amid rising risks.

This “uninsurable future” is eroding home values, with properties in high-exposure areas seeing a $20,500 drop due to insurance costs, according to a New York Times analysis.

Renters aren’t immune, as higher landlord premiums trickle down, straining affordable housing.

📚 You May Also Like

💡Massive Obamacare Premium Increases in 2026: Millions Face Sharp Cost Hikes as Subsidies Expire

Learn which US-based attorneys provide the strongest legal representation and highest claim success rates this year.

🚗 How Much Does Personal Umbrella Insurance Cost in 2025? A Complete USA Guide

Explore top-rated US attorneys helping victims maximize compensation for damage and medical expenses which came under Umbrella Insurance.

⚖️Farm Liability Insurance for Agritourism Businesses: Essential Protection for U.S. Farmers

Discover the pros and cons of managing your Farm insurance claim independently versus hiring a legal expert.

🔥 Best Agricultural Insurance for Organic Farms in the USA: 2025 Expert Guide

See how USA ranks and what factors drive up insurance rates across the country.