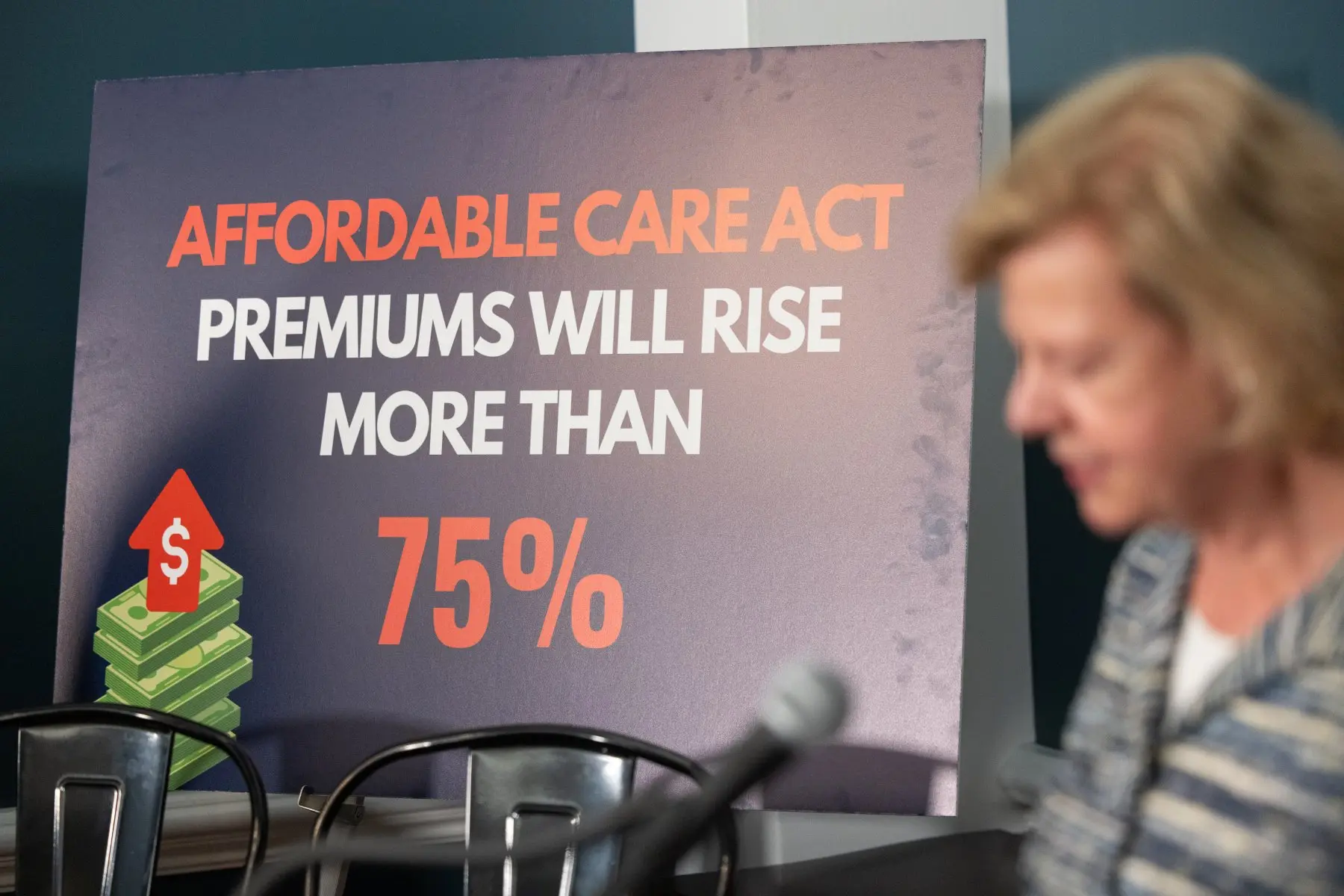

Obamacare Premium Increases 2026 are shaping up to be one of the most significant shifts in the U.S. health insurance marketplace since the Affordable Care Act (ACA) launched. Millions of Americans who rely on subsidized marketplace plans are now facing steep cost hikes after temporary enhanced tax credits expired. According to preliminary insurer filings and state exchange projections, many 2026 ACA plans are showing premium increases of 100% or more, with states like Florida, Texas, and Georgia expected to experience the largest spikes.

The timing could not be worse. Enrollment for 2026 marketplace coverage opened on November 1, yet many families are delaying sign-ups or even considering going uninsured due to rising monthly premiums. Policy analysts say participation could drop sharply, which may further drive up costs in the coming years.

Why the Premiums Are Increasing So Sharply

The core driver behind the Obamacare Premium Increases 2026 is the expiration of enhanced ACA subsidies created through pandemic-era legislation. Under the previous subsidy expansion, millions of households saw premiums reduced dramatically. Some families were paying as little as $20–$60 per month for silver-tier marketplace plans.

Now that the expanded tax credits have lapsed:

- Middle-income Americans are losing eligibility for cost-sharing reductions.

- Lower-income Americans are seeing subsidies fall back to pre-2021 levels.

- Households who once qualified for near-zero premiums now face full-price plans.

In practical terms, this means that a family that previously paid $450 per month may now be quoted $1,100 to $1,400 per month for comparable coverage.

Health insurers cite additional factors contributing to the increase:

| Contributing Factor | Impact on Premiums |

|---|---|

| Higher medical service utilization | Raises insurer claim expenses |

| Inflation in hospital and drug pricing | Drives up plan operating costs |

| Reduced marketplace enrollment | Smaller risk pool increases per-person costs |

| Increasing chronic condition incidence | Higher long-term coverage requirements |

Real-Life Example: Texas Family Faces 167% Increase

Personal stories illustrate how disruptive these price changes are.

A family in Dallas, Texas reported that their marketplace plan premium jumped from $450 monthly to $1,200, even before considering higher deductibles and copayments.

The mother, who works as a preschool teacher, explained:

“We don’t qualify for Medicaid. We make too much for big subsidies now. But we don’t make enough to handle $1,200 every month either. I don’t know what we’re supposed to do.”

This experience aligns with national estimates showing cost impacts hitting middle-income Americans the hardest.

States Most Affected by Obamacare Premium Increases in 2026

While price increases vary state to state, regions with fewer insurers tend to see the sharpest hikes.

| State | Average Reported Increase | Notable Factors |

|---|---|---|

| Florida | 120–150% | High uninsured rate, limited insurer competition |

| Texas | 95–160% | Loss of subsidies impacts mid-market families |

| Georgia | 90–140% | Rural healthcare cost inflation |

| Arizona | 85–125% | Large deductibles and limited plan networks |

| Nevada | 80–110% | Marketplace consolidation reduces consumer choice |

Consumers in rural counties across Florida and Texas are expected to face the steepest premium increases nationwide.

What This Means for Enrollment in 2026

Experts expect reduced ACA enrollment for 2026, especially among:

- Younger adults

- Self-employed individuals

- Small business owners

- Households slightly above the subsidy eligibility line

Lower enrollment risks creating a feedback loop:

- Healthier people leave the marketplace.

- Remaining enrollees are more medically expensive.

- Plans raise premiums further next year.

This cycle is known as a risk pool compression effect, and it has already occurred in multiple state markets in past years.

Are There Affordable Alternatives?

For Americans concerned about the Obamacare Premium Increases 2026, several legal options remain:

| Alternative Coverage Type | Pros | Cons |

|---|---|---|

| Employer-Sponsored Plans | Lower premiums; more stable pricing | Only helpful if employer offers coverage |

| Medicaid (if eligible) | Low-cost or no-cost coverage | Income eligibility caps vary by state |

| High-Deductible + HSA Plans | Lower monthly premiums | Higher out-of-pocket costs before coverage |

| Cost-Sharing Ministries | Very low monthly cost | Not legally insurance; limited protections |

Policy advisers recommend:

- Rechecking state marketplace eligibility.

- Comparing bronze vs. silver tier plans carefully.

- Reviewing regional insurer networks, not just total monthly cost.

Policy Debate: Will Subsidies Be Reinstated?

Lawmakers remain divided on whether to extend enhanced ACA subsidies again:

- Supporters argue that subsidies are essential to stabilize American health coverage and prevent uninsured population spikes.

- Critics argue that temporary subsidies inflated premiums artificially and masked underlying cost issues.

Congressional negotiations were delayed earlier this year, contributing to uncertainty in the insurance market.

A federal decision is expected in mid-2026, though analysts warn that renewed subsidies might not arrive in time to prevent enrollment losses.

How Americans Can Prepare for 2026 Enrollment

If you expect to be affected, consider the following steps:

- Log in to your state or federal health marketplace early.

- Compare at least 6–8 plan options, not just the default renewal plan.

- Check whether your preferred doctors and hospitals are in-network.

- Review deductibles and out-of-pocket maximums, not just premiums.

- Evaluate whether your income qualifies for any subsidy tier, even partial.

Proactive comparison can reduce cost shock and help avoid surprise annual medical bills.

The Obamacare Premium Increases 2026 represent a major turning point for U.S. healthcare affordability. With enhanced subsidies expired, many households are facing premium increases of 100% or more and may struggle to maintain consistent coverage. The situation is especially challenging for middle-income Americans who earn too much for subsidies but not enough to comfortably absorb rising insurance costs.

Whether Congress extends subsidies or introduces new stabilization measures could determine how accessible marketplace coverage remains over the next several years. For now, consumers are encouraged to review coverage options closely and prepare early during the 2026 open enrollment period.

📚 You May Also Like

💡US Social Security Survivors Benefits News 2025: What Families Should Know About the Latest SSA Changes

Learn which U.S.-based attorneys provide the strongest legal representation and highest claim success rates this year.

🚗 Auto Insurance Attorney in the USA – 2025 Legal Help, Top Lawyers, and Filing Guide

Explore top-rated USA attorneys helping victims maximize compensation for vehicle damage and medical expenses.

⚖️ Health Insurance Quotes in the USA: A Clear Guide to Choosing the Right Coverage

Discover the pros and cons of managing your car insurance claim independently versus hiring a legal expert.

🔥 National General Insurance Customer Service: Your Complete 2025 Guide to Support, Reviews, and Legal Recourse

See how U.S. ranks and what factors drive up insurance rates across the country.