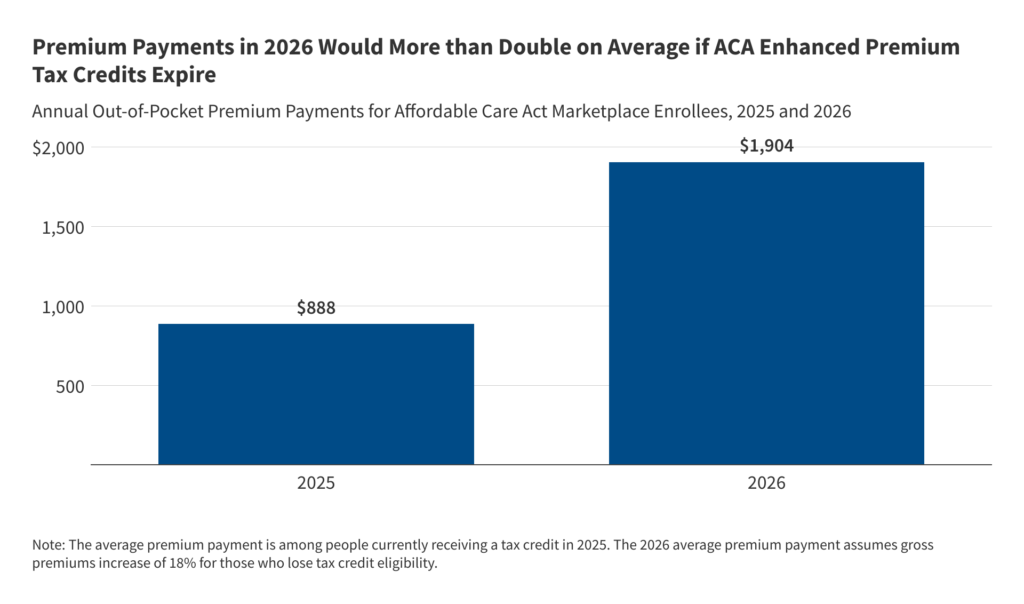

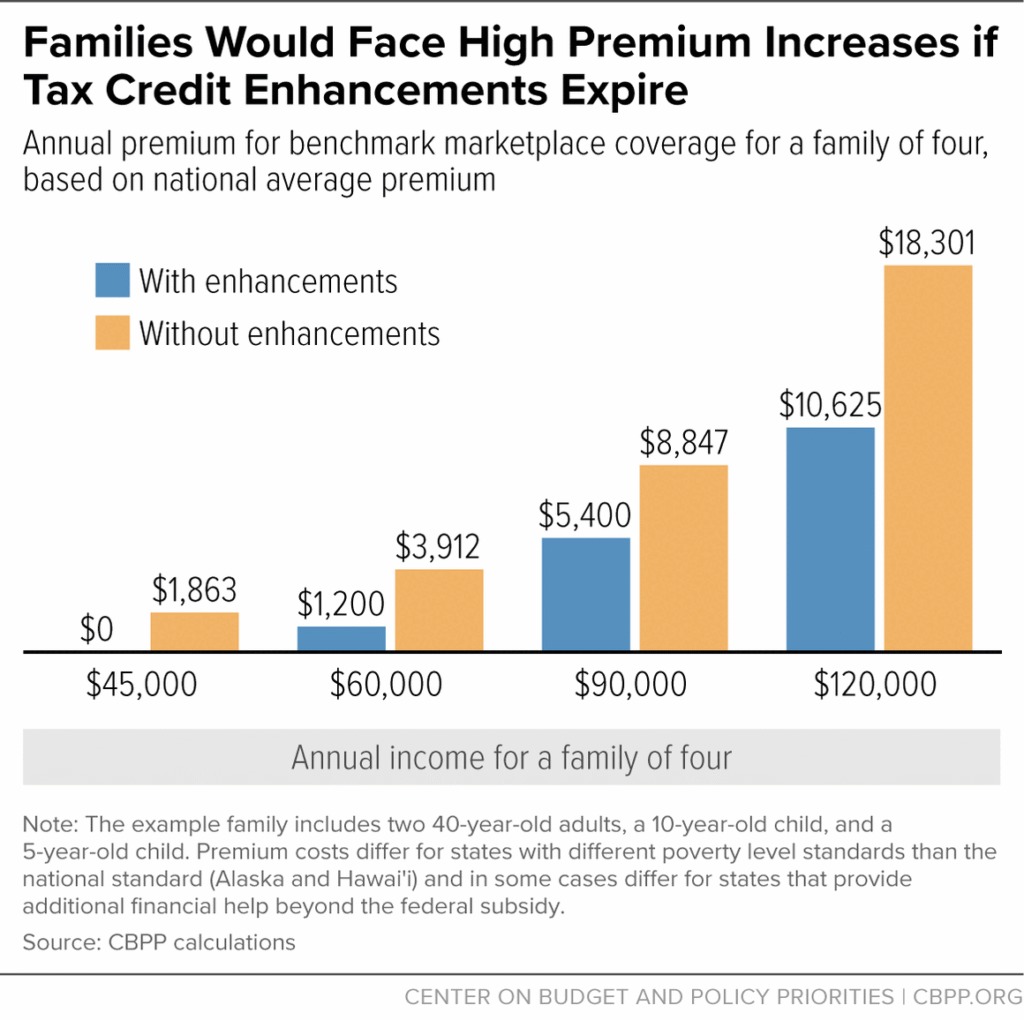

ACA Premium Spikes in 2026 are hitting millions of Americans hard as enhanced Affordable Care Act (ACA) subsidies expire on December 31, 2025, leading to sharp increases in out-of-pocket costs and many opting to drop coverage altogether. According to the Kaiser Family Foundation (KFF), subsidized enrollees’ average annual premium payments are projected to more than double, rising 114% from $888 in 2025 to $1,904 in 2026. This surge particularly affects small business owners, self-employed individuals, and middle-income families who rely on marketplace plans without employer-sponsored options.

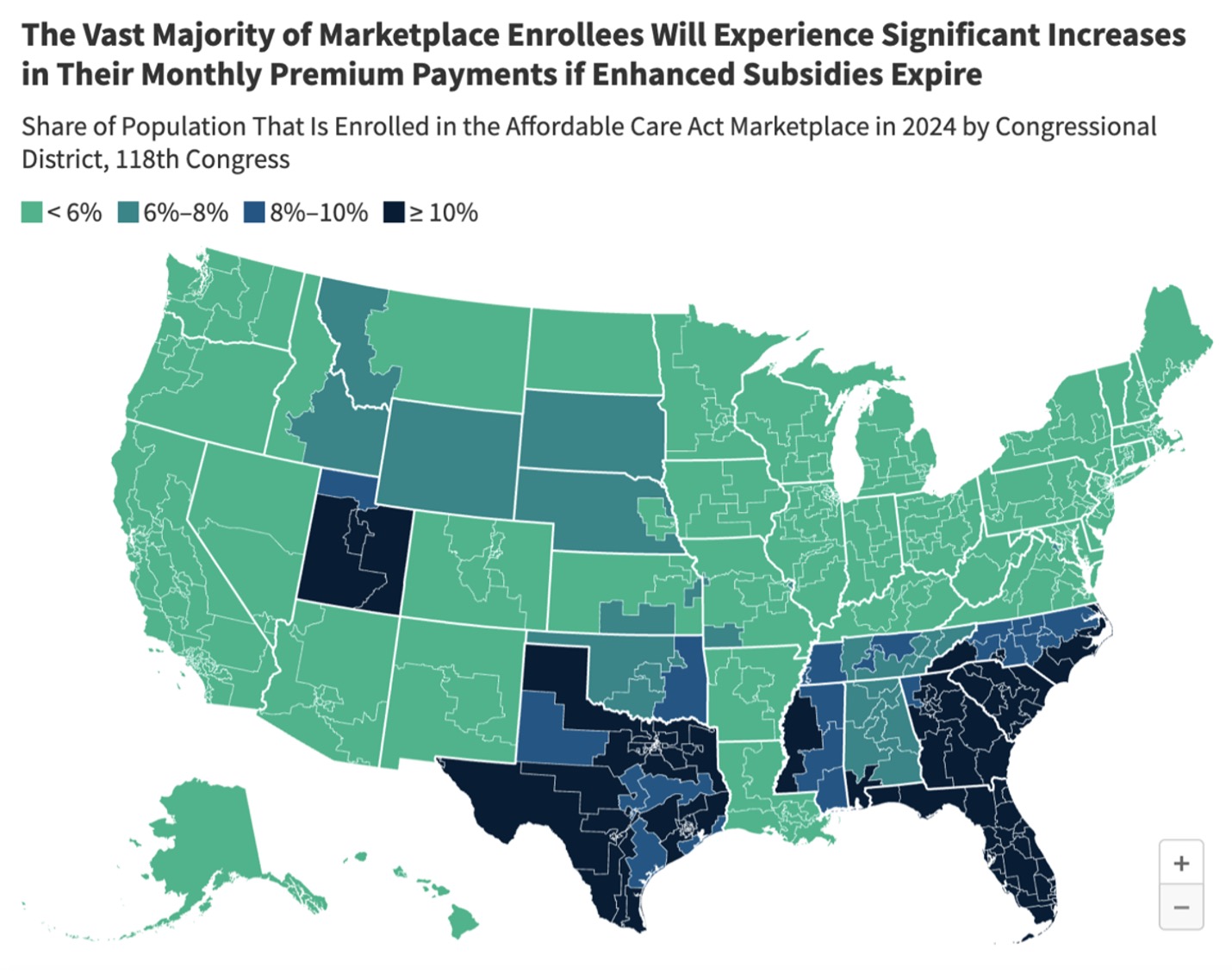

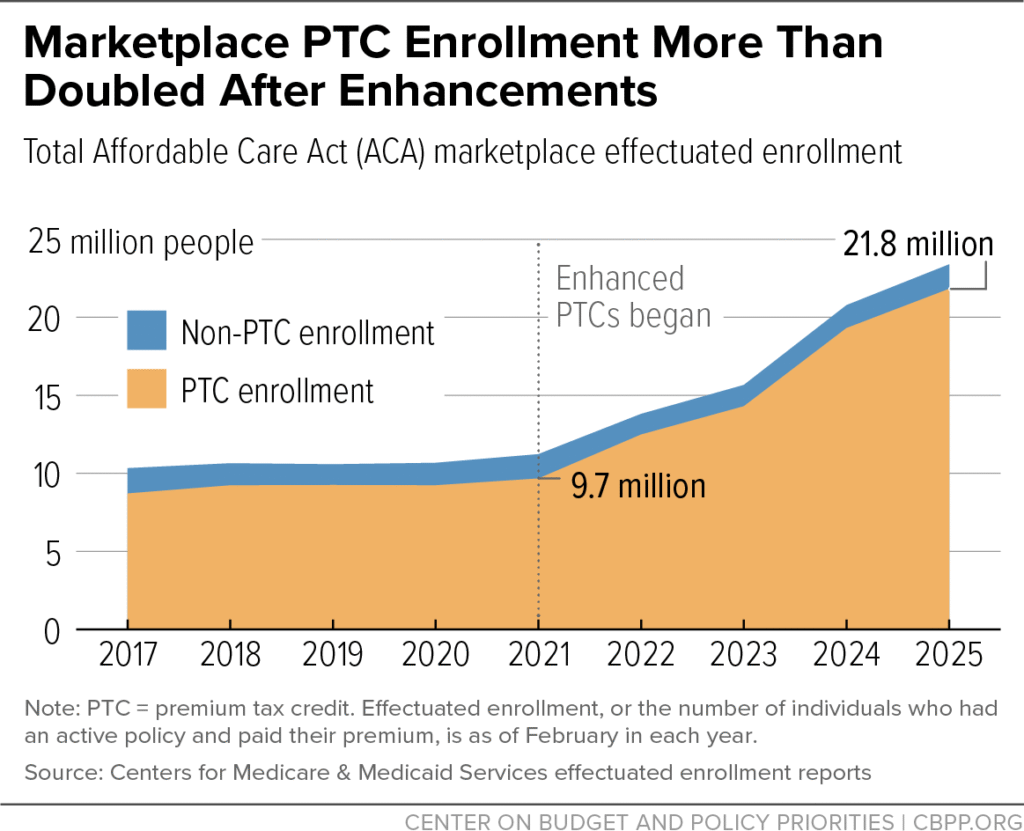

The enhanced premium tax credits, introduced by the American Rescue Plan Act in 2021 and extended through 2025 by the Inflation Reduction Act, made coverage more affordable by capping contributions at 8.5% of income and eliminating the “subsidy cliff” for those earning above 400% of the federal poverty level. Without congressional action to extend them, these benefits lapse, reverting to less generous pre-2021 rules. KFF estimates that roughly 22 million subsidized enrollees—about 92% of marketplace participants—will see higher costs, with some middle-income households facing increases of thousands of dollars annually.

Small business owners and the self-employed are disproportionately impacted, as they often lack access to group plans. Reports indicate over 5 million such individuals enrolled in ACA marketplaces in 2025, many now considering going uninsured or cutting benefits. In states like Vermont and California, where enrollment is high, owners report premiums doubling or more, forcing tough choices amid other rising business costs. Women frequently bear additional burdens, navigating complex family coverage options during open enrollment.

Broader consequences include potential coverage losses: The Congressional Budget Office and Urban Institute project 3-4.8 million more uninsured Americans in 2026 if subsidies expire. Some states, like California, are providing limited supplemental aid for lower-income residents, but it won’t cover everyone. Insurers have also raised underlying premiums by an average 26% for 2026, factoring in expected healthier enrollees dropping out.

While Congress failed to extend the subsidies before year-end, experts suggest a retroactive fix or special enrollment period could emerge in 2026. For now, enrollees should review options on Healthcare.gov or state exchanges before deadlines, potentially switching to lower-cost bronze plans or exploring state assistance.

📚 You May Also Like

💡The Surge in Health Insurance Premiums: Navigating the 2026 Crisis in the USA

Learn which USA-based attorneys provide the strongest legal representation and highest claim success rates this year.

🚗 Workers Compensation for Seasonal Farm Laborers in the USA: 2025 Complete Guide

Explore top-rated USA attorneys helping victims maximize compensation for Farm damage and medical expenses.

⚖️ Best Agricultural Insurance for Organic Farms in the USA: 2025 Expert Guide

Discover the pros and cons of managing your Organic farm insurance claim independently versus hiring a legal expert.

🔥Does Crop Insurance Cover Flood Risks in Midwest? The Complete 2025 USA Guide

See how US ranks and what factors drive up insurance rates across the country.