For millions of Americans, Social Security Administration (SSA) retirement benefits form a foundation of their retirement income. With evolving policy, cost-of-living adjustments, trust-fund concerns, and legislative developments, staying informed on social security retirement news USA is more important than ever.

In this article, we’ll cover:

- Major recent headlines in Social Security retirement news

- What the changes mean for you—both current and future retirees

- Expert legal counsel resources if you need professional guidance

- Practical steps you should take now

Major Headlines & Why They Matter

Benefit Increase for 2026

The SSA announced a 2.8% cost-of-living adjustment (COLA) beginning January 2026 for roughly 71 million beneficiaries, translating into an average increase of about $56/month for the typical retirement benefit.

While it’s a welcome boost, many retirees say it doesn’t keep pace with rising costs of housing, food and healthcare.

Trust Fund & Solvency Issues

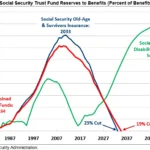

According to the SSA’s 2025 Trustees Report, the combined Old-Age & Survivors Insurance (OASI) trust fund may be depleted by 2034, a year sooner than previously projected.

This raises concern: if no legislative action is taken, benefits could be cut or tax rates increased—impacting both current beneficiaries and future retirees.

Retirement Age, Eligibility & Claiming Patterns

A survey revealed that 90% of Americans plan to claim retirement benefits early (before age 70), despite financial advisers often recommending later claiming to maximise benefits.

Additionally, changes to “full retirement age” (FRA) and eligibility rules are on the table—meaning tomorrow’s retirees may face different timelines than today’s.

Digital Modernisation of SSA

The SSA is moving toward a more digital service delivery model—including ending physical checks, deploying chatbots, and redirecting staff to phone/online service.

While this may improve efficiency, advocates warn that older adults without internet access may be disadvantaged.

Expert Legal Counsel & Firms for Social Security Retirement Issues

If you have questions about retirement benefit eligibility, claiming strategy, appeals of denied benefits, or the impact of new rules on your situation, consulting a qualified attorney is wise. Here are some U.S. law firms specializing in Social Security and retirement benefits:

- Law Offices of Cory A. DeLellis – California-based practice offering guidance on Social Security retirement and disability benefits. Website: corydelellislaw.com

- Ryan Bisher Ryan & Simons – Michigan law firm handling Social Security disability claims, retirement strategies and benefit appeals. Website: rbrlawfirm.com

- Seyfarth Shaw LLP – National firm with an “Aviation, Airports & Aerospace” group that also covers retirement benefit litigation and employee/employer issues including Social Security. Website: seyfarth.com

Before engaging counsel, ask about their experience with retirement-benefit strategy, fee structure, and whether they handle appeals or changes in Social Security policy.

What These Developments Mean for You

If You’re Already Receiving Benefits

- Your upcoming benefit check will likely increase with the 2026 COLA.

- Even so, if your expenses are rising faster than 2.8% you may still feel a squeeze.

- Bank on a stable but challenged future for the Social Security system—don’t assume large unchecked increases.

If You’re Planning to Retire in the Next 5-10 Years

- Re-evaluate the age at which you plan to claim benefits; delaying may still maximise your monthly amount.

- Monitor policy changes—age thresholds, benefit formula reforms, payroll tax caps may shift in your favour or disadvantage.

- Treat Social Security as one pillar of income—don’t rely on it alone. Build savings, investments and other income streams.

Claiming Early vs Waiting

- Claiming early (age 62) reduces monthly benefit but gives you income sooner; waiting raises benefit. The survey showing 90% plan to claim early signals financial pressures and potential sub-optimal decisions.

- Work with a planner or attorney to compute your “break-even” point—when delaying pays off in lifetime benefits.

Practical Steps You Should Take Now

- Check your Social Security Statement: Log in to your account at the SSA website, view your earnings record, estimated retirement benefits, and dates.

- Review your retirement plan: How much of your income will Social Security cover? Many retirees rely on it for 40–50% of income—understanding the gap is critical.

- Consider your claiming strategy: Use calculators or meet an advisor/lawyer to decide when to claim.

- Stay alert to policy shifts: Follow the latest news—COLA announcements, trust-fund updates, legislative proposals.

- Plan for worst-case scenarios: If benefits are cut or delayed, you should have a backup (savings, pension, part-time work).

- Engage legal counsel if needed: If you have complex work history, spousal benefits, or survivor issues, talking to a counsel listed above can save time and money.

📚 You May Also Like

💡 US Social Security Survivors Benefits News 2025: What Families Should Know About the Latest SSA Changes

Learn which U.S.-based attorneys provide the strongest legal representation and highest claim success rates this year.

🚗 Retirement Disability Benefits News USA: Latest Updates, Legal Insights, and What You Should Know

Explore top-rated U.S. attorneys helping victims maximize compensation for vehicle damage and medical expenses.

⚖️Retirement, Survivors & Disability Insurance News: Why It Matters Now

Discover the pros and cons of managing your car insurance claim independently versus hiring a legal expert.

🔥Social Security OASDI Updates: What’s New and What It Means for You

See how U.S. ranks and what factors drive up insurance rates across the country.

One thought on “Social Security Retirement News USA: What You Need to Know”