The dominant story in U.S. insurance right now is the expiration of enhanced Affordable Care Act (ACA) premium tax credits on December 31, 2025, leading to significant health insurance premium increases starting January 1, 2026.

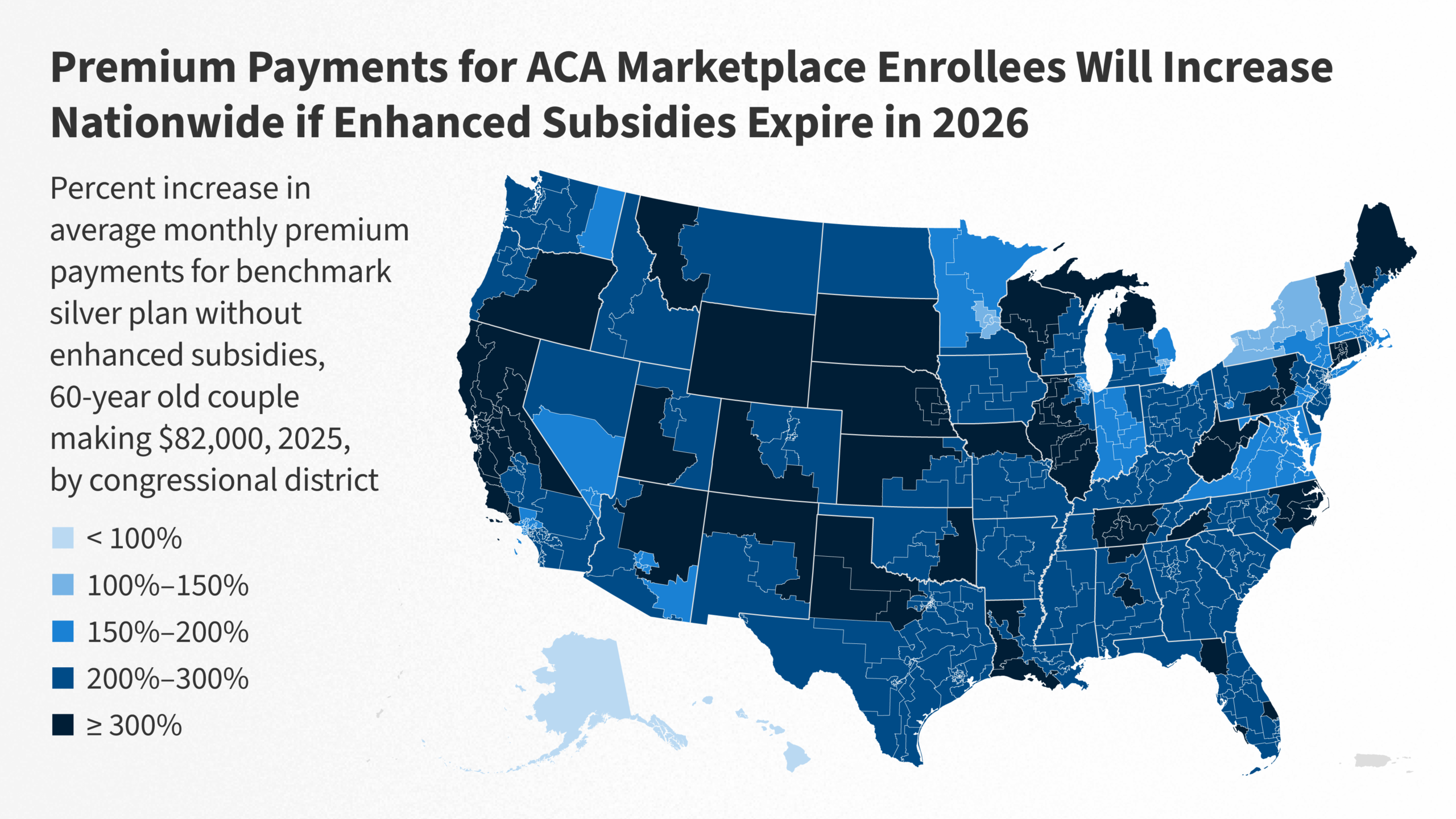

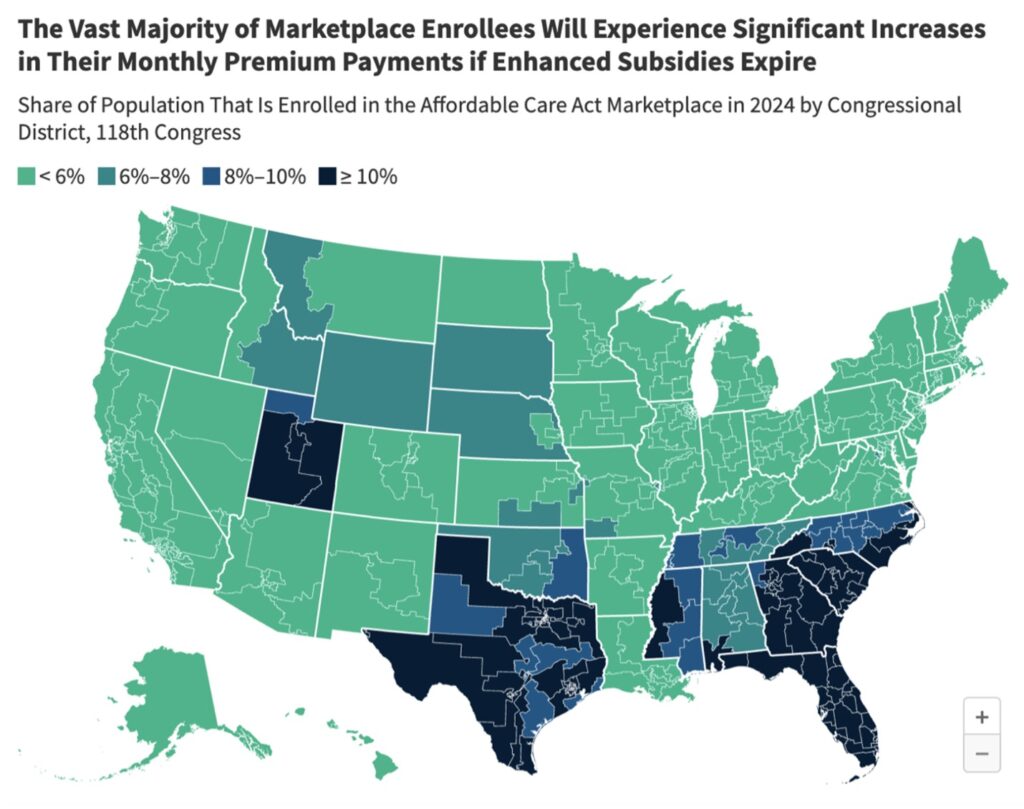

- Premium Spikes and Coverage Losses: Millions of Americans are facing sharply higher health insurance costs under ACA marketplace plans. On average, subsidized enrollees are seeing premiums more than double (rising 114% from about $888 in 2025 to $1,904 in 2026, per KFF analysis). Some individuals report premiums tripling or quadrupling, forcing tough choices like dropping coverage or switching to cheaper, higher-deductible plans. Estimates suggest 4-5 million people could become uninsured as a result.

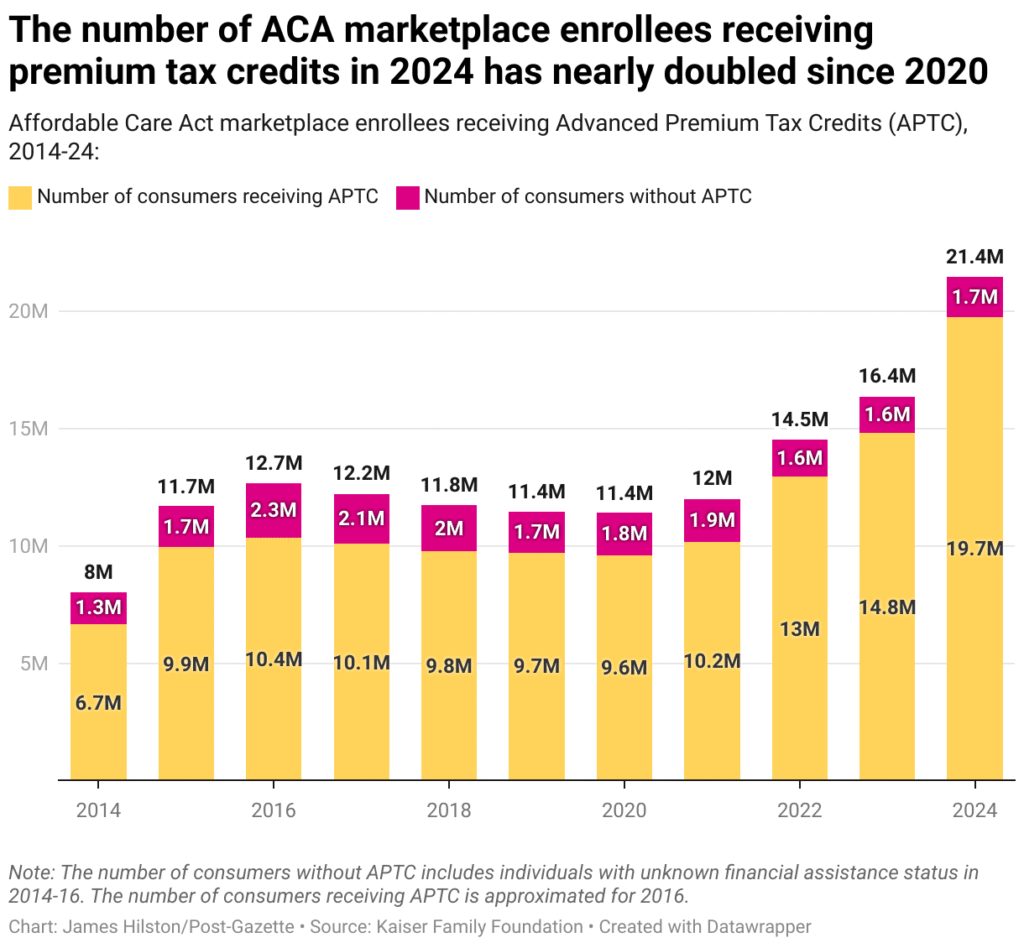

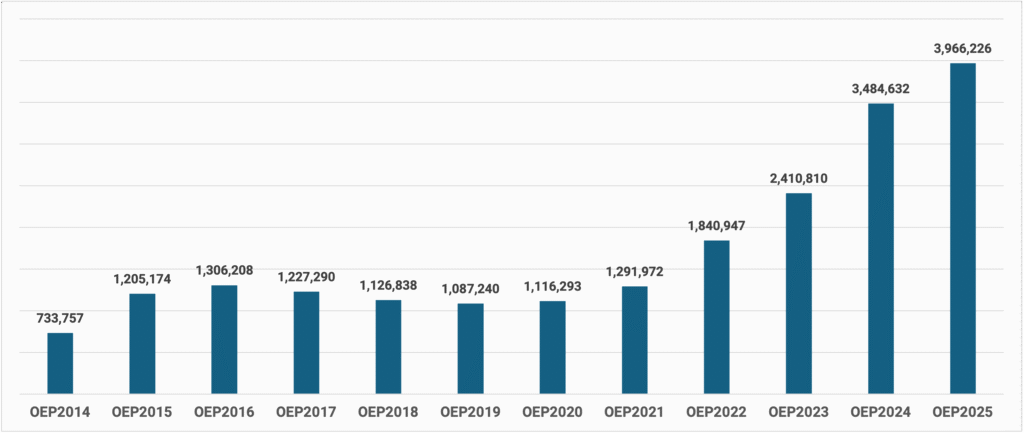

- Enrollment Impact: ACA marketplace enrollment for 2026 has dipped to around 15.6 million, down from prior years when enhanced subsidies boosted participation to over 20 million.

- Political Context: Congress failed to extend the subsidies before the deadline, despite bipartisan attempts stalled by gridlock. A potential vote on extension is expected in early January 2026, which could include retroactive relief and a special enrollment period.

- Affected Groups: This impacts self-employed workers, small business owners, and others not covered by employer plans, Medicaid, or Medicare. Over 20 million people previously benefited from the enhanced credits.

Other Notable Developments

- Federal Employee Health Benefits: A new policy effective 2026 excludes coverage for gender-affirming care in federal employee insurance programs, prompting a class action lawsuit from affected workers.

- Medicare Changes: New limits on certain supplemental benefits in Medicare Advantage plans; negotiated drug prices under the Inflation Reduction Act take effect for select high-cost medications.

- Property/Casualty Sector: In contrast to health insurance turmoil, some positive trends in auto and property lines—e.g., Florida seeing auto rate reductions and refunds totaling nearly $1 billion due to market improvements post-reforms. Industry mergers/acquisitions continue, with focus on AI, technology, and specialty lines.

- Broader Industry: Reinsurance renewals saw price declines; ongoing M&A activity .

Health insurance affordability under the ACA remains the top headline, with potential for updates if Congress acts soon. For property/auto insurance, markets appear stabilizing in high-risk states like Florida.

📚 You May Also Like

💡ACA Premium Spikes in 2026: Millions Face Doubled Costs and Dropping Coverage After Subsidy Expiration

Learn which US-based attorneys provide the strongest legal representation and highest claim success rates this year.

🚗 The Surge in Health Insurance Premiums: Navigating the 2026 Crisis in the USA

Explore top-rated USA attorneys helping victims maximize compensation for medical expenses.

⚖️ Louisiana Car Insurance Rates 2026: New Laws Bring Relief with Rate Decreases

Discover the pros and cons of managing your insurance claim independently versus hiring a legal expert.

🔥 US Car Insurance Profitability 2025: A Comprehensive Analysis

See how US ranks and what factors drive up insurance rates across the country.